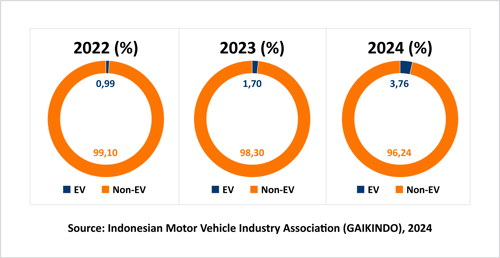

The prospects of Indonesia's electric vehicle (EV) industry are promising, as evidenced by the increase in the share of EVs compared to non-electric vehicles, rising from 0.99% in 2022 to 3.70% in 2024 out of the total vehicle population in the country.

Additionally, Indonesia holds 40-45% of the world's nickel reserves, making it the largest nickel ore and tin metal supplier globally. These materials are essential raw inputs for the production of EV batteries and play a critical role in the global EV industry's growth.

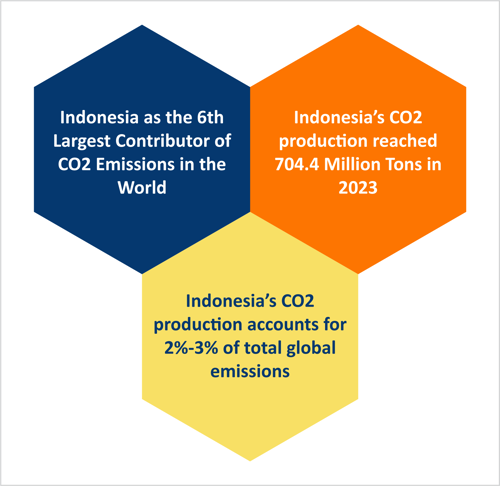

Indonesia, with a significant population of motor vehicle users, faces the challenge of rising emissions from motor vehicles each year. To tackle this issue, the government is implementing a Zero-Emission program aimed at reducing emissions and creating a cleaner, more environmentally friendly future. This program seeks to reduce the carbon footprint produced by the transportation, industrial, and energy sectors.

The Indonesian government has taken steps to curb emissions in the transportation sector through policies encouraging the adoption of EVs and more fuel-efficient vehicle technologies. EVs are believed to significantly reduce CO₂ emissions, with estimated reductions ranging between 60% and 70% compared to fossil fuel-powered vehicles—and potentially even higher when EVs are charged using renewable energy sources.

Despite challenges related to energy infrastructure and vehicle production, the transition to EVs remains one of the most effective solutions for reducing the carbon footprint in the transportation sector.

Production and Sales of Electronic Vehicles in Indonesia

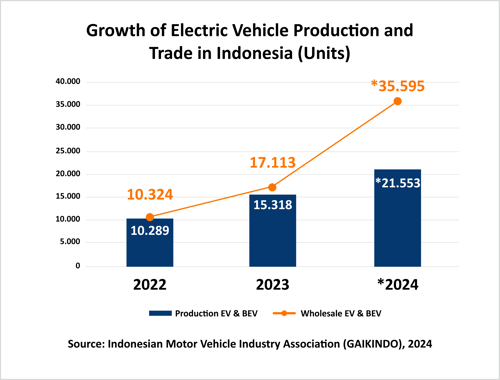

Since 2022, the production of electric vehicles (EVs) in Indonesia has continued to grow. According to data from the Association of Indonesian Automotive Manufacturers (GAIKINDO), Indonesia's EV production reached 15,318 units in 2023, with sales, including imports, amounting to 17,113 units.

This represents an increase from 2022, when EV production stood at 10,289 units, and wholesale sales totaled 10,324 units. The rising figures reflect the growing enthusiasm of the Indonesian public toward EVs, although adoption remains in its early stages compared to conventional vehicles.

Several factors contribute to the increasing interest of Indonesians in electric vehicles, including:

1. Government-Supported Policies

The Indonesian government, through the Ministry of Industry and the Ministry of Energy and Mineral Resources (ESDM), actively supports the development of electric vehicles (EVs) in the country

2. Improved Infrastructure

Charging infrastructure for EVs is also advancing rapidly. With the establishment of more charging stations in urban areas and other key regions, the convenience of charging EVs has made them more practical and appealing to consumers. Large-scale projects, such as the construction of supercharger networks by several EV manufacturers, have further boosted public confidence in EVs.

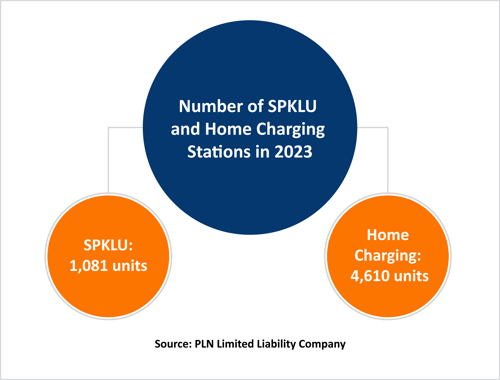

According to a report by PT Perusahaan Listrik Negara (PLN Persero), the number of Public Electric Vehicle Charging Stations (SPKLU) in Indonesia reached 1,081 units by the end of 2023. This figure includes SPKLU units owned by PLN, its partners, and private entities. In 2023 alone, 624 SPKLU units were added across 411 locations throughout Indonesia, comprising 582 independently installed units and 42 units established through partnership schemes.

In addition, 3,729 home charging units were installed in 2023, a fivefold increase compared to 2022. PLN recorded a total of 4,610 home charging units currently connected to PLN's electricity network.

3. Growing Environmental Awareness

A growing portion of society is becoming increasingly aware of the environmental impact caused by fossil-fuel-powered vehicles, such as air pollution and carbon emissions. With this awareness, electric vehicles have emerged as a more environmentally friendly option, and many people are choosing them as an alternative to reduce their carbon footprint.

Indonesia, as a country with significant air pollution levels in several major cities, is also encouraging the public to transition to cleaner vehicles.

This public awareness is also rising in line with Indonesia's status in the global carbon emissions issue.

4. Price and Accessibility

While the initial cost of electric vehicles (EVs) typically surpasses that of traditional vehicles, a confluence of factors such as government incentives and decreased production costs, particularly for Battery Electric Vehicles (BEVs), is contributing to their growing affordability. By 2023, the price gap between electric and fossil-fuel-powered vehicles has narrowed considerably, spurred by the introduction of more budget-friendly EV models, coupled with supportive policies like subsidy programs and reduced tax rates.

5. More Brands and Options

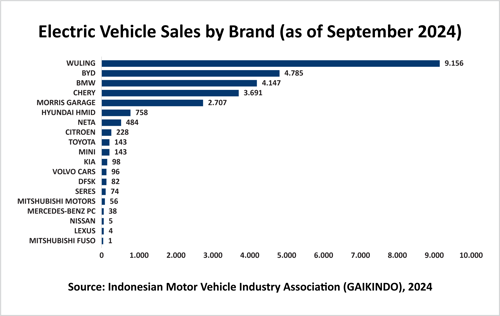

Global and local manufacturers are showing growing interest in entering Indonesia's electric vehicle market, offering a wider variety of EV options in terms of price, features, and models.

According to GAIKINDO data, as of September 2024, a total of 26,696 electric vehicles have been sold. The top-selling brand is WULING with 9,156 units sold, followed by BYD with 4,785 units, BMW with 4,147 units, CHERY with 3,691 units, and MORRIS GARAGE with 2,707 units. These five brands account for over 10% of total EV sales, while other brands remain below 3%.

6. Intensive Promotion and Marketing of Electric Vehicles

Various promotional and marketing efforts by the government, media, and electric vehicle manufacturers have significantly raised public awareness of the benefits of electric vehicles, both from an environmental, economic, and technological perspective.

International Electric Vehicle Trade in Indonesia 2024

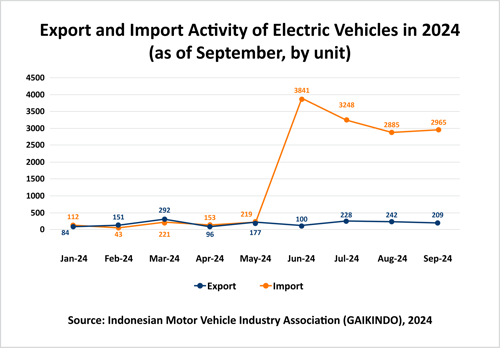

As of September 2024, Indonesia has exported 1,577 electric vehicles and imported 13,685 units. In terms of monthly developments, imports saw a significant surge starting in June 2024. The import volume increased nearly 20 times compared to the previous month, then steadily decreased by 1-2% each month until August 2024. This spike was driven by growing public interest in electric vehicles, which led to demand exceeding domestic production capacity.

Looking at export destinations, among the 1,577 electric vehicles exported, Singapore is the largest destination, receiving 521 units (33%). Following Singapore, Thailand received 456 units (27%), and India imported 274 units (17%).

For imports, of the total 13,865 electric vehicles imported, China is the largest supplier, with 12,020 units (88%), followed by Germany with 630 units (5%), and India with 228 units (2%).

Prospects of the Electric Vehicle Industry Domestically and Globally

Indonesia plays a crucial role in global electric vehicle (EV) development, especially due to its supply of nickel, which is essential for manufacturing EV batteries. According to the Ministry of Energy and Mineral Resources (ESDM), by 2024, Indonesia is expected to have 40-45% of the world's nickel reserves, amounting to 5.32 billion tons of nickel ore and 56.11 million tons of nickel metal. This has significantly increased Indonesia’s attractiveness globally.

From the perspective of the growth of electric vehicle populations in Indonesia compared to non-electric vehicles, there has been a steady increase in the percentage of electric vehicles each year.

According to GAIKINDO data for 2024, the percentage of electric vehicles in 2022 was 0.99% of the total vehicle population in Indonesia. In 2023, this rose to 1.70%, indicating a growing interest in electric vehicles among the public. With this continued momentum, in 2024, the percentage of electric vehicles more than doubled from 2023, reaching 3.76%.

Based on these trends, CRIF believes the outlook for electric vehicles in Indonesia is very positive, given the consistent rise in electric vehicle purchases each year. Although non-electric vehicles still dominate the market overall, the significant supply of nickel, a key material for battery production and the energy source for electric vehicles, makes Indonesia’s EV industry a promising option for long-term investment.

However, several challenges need to be addressed, including:

-

Lack of public understanding of electric vehicle technology.

-

Range anxiety, although this is improving with advancements in battery technology.

-

Limited charging infrastructure in certain regions.

Therefore, investors should be selective and target investments that can tackle these three challenges. By 2025, the prospects for electric vehicles in Indonesia show a very positive trend, despite the aforementioned challenges. The Indonesian government targets around 2 million electric vehicles, including cars and motorcycles, to be operational in society by that year. The electric car sector, in particular, is expected to produce around 400,000 units in 2025, representing about 25% of the total production of four-wheeled vehicles in Indonesia. This includes substantial investments in the electric vehicle industry and supporting infrastructure such as charging stations.

The government has also encouraged manufacturers to increase production capacity and has attracted large investments in battery manufacturing plants for electric vehicles, with a total investment estimated at $15.3 billion. However, achieving these targets is highly dependent on the development of infrastructure, supportive policies, and consumer adoption. The government needs to address challenges related to the cost of electric vehicles, charging infrastructure, and the acceleration of production for key components such as batteries.