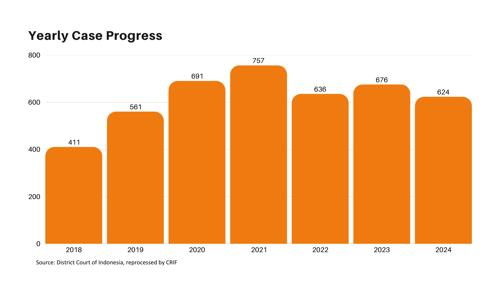

Throughout 2024, the number of PKPU (Postponement of Debt Payment Obligations) and bankruptcy cases has declined compared to the previous year. According to data compiled by CRIF Indonesia in February 2025, 624 PKPU and bankruptcy cases were registered across five commercial courts between January and December 2024. This figure is lower than in 2023, which saw 676 cases.

PKPU cases involving businesses in Indonesia remain in the spotlight, whether they originate from publicly listed or non-listed companies. After experiencing a 6.29% increase in 2023, bringing the total to 676 PKPU cases, the number declined again in 2024 by 7.69%.

CRIF Indonesia assesses that PKPU and bankruptcy cases in 2024 remained relatively stable, without any major disruptions or significant developments. However, according to the Central Bureau of Statistics, Indonesia’s economic growth slowed to 5.03% in 2024 (compared to 5.05% in 2023), falling below the government’s 5.2% target. The manufacturing sector and household consumption, the two main drivers of the economy, grew below their potential, while exports also weakened. Given these conditions, CRIF Indonesia predicts that PKPU cases may rise again in 2025, with hopes that this increase will lead to optimal debt restructuring for both debtors and creditors.

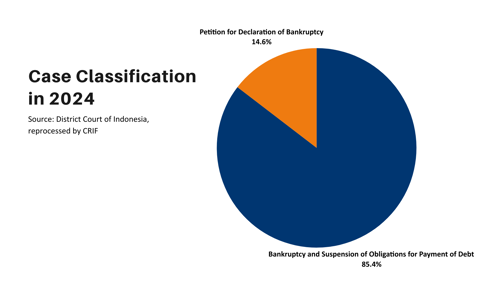

Of the 624 PKPU cases recorded, 85% were categorized under “Bankruptcy and Suspension of Obligations for Payment of Debt,” while the remaining 15% were classified as “Petition for Declaration of Bankruptcy.”

Compared to the previous year, cases of “Bankruptcy and Suspension of Obligations for Payment of Debt” declined from 592 to 533 cases. Meanwhile, “Petition for Declaration of Bankruptcy” cases increased from 84 to 91.

The increase in Postponement of Debt Payment Obligations (PKPU) cases is often linked to economic slowdowns and declining net export performance. CRIF Indonesia has identified several key connections:

-

Corporate Liquidity Pressure

-

When economic growth slows and net exports weaken, many companies—especially those reliant on international trade—face cash flow difficulties.

-

A higher increase in imports compared to exports can widen the trade deficit, making it harder for domestic companies to compete and increasing the risk of defaults.

-

Weakening of Industrial and Trade Sectors

-

A sluggish export sector directly impacts manufacturing and trade industries. Many businesses may experience declining demand, making it difficult to meet debt obligations, potentially leading to PKPU filings.

-

Exchange Rate Volatility and Debt Burden

-

A net export deficit can affect the rupiah's exchange rate. If the rupiah weakens, companies with foreign-currency debt will face higher repayment burdens, increasing the likelihood of PKPU cases.

-

Rising Financial Strain and Debt Restructuring

-

Businesses affected by economic slowdowns tend to seek debt restructuring through PKPU mechanisms to survive. If this trend becomes widespread, PKPU cases could rise further.

In summary, if exports weaken while imports remain high, domestic business competitiveness may decline, causing more companies to struggle with their financial obligations and seek debt restructuring.

Sectors Most Vulnerable to Debt Restructuring and Bankruptcy

Separately, researchers from the Institute for Economic and Social Research, Faculty of Economics and Business, University of Indonesia (LPEM FEB UI) have assessed that, based on Indonesia’s economic conditions throughout 2024, the country is entering 2025 with signs of economic weakening (Kompas.id).

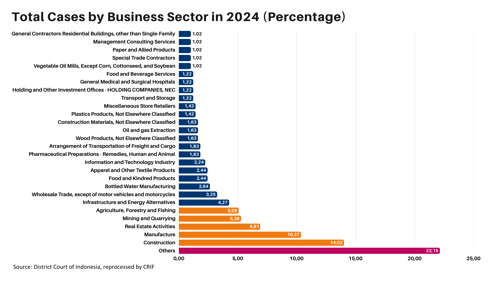

According to case records from 2024, the sectors with the highest number of debt restructuring and bankruptcy cases were:

-

Construction – 69 cases

-

Manufacturing – 51 cases

-

Real Estate – 34 cases

-

Mining and Quarrying – 26 cases

-

Agriculture, Forestry, and Fishing – 25 cases

These five sectors recorded the highest number of cases compared to other industries.

By the end of 2024, 12 publicly listed companies were still undergoing debt restructuring processes. Among them were three state-owned enterprises:

-

PT Indofarma Tbk (INAF)

-

PT Waskita Karya Tbk (WSKT)

-

PT PP Properti Tbk (PPRO)

Additionally, most publicly listed companies facing debt restructuring had illiquid stocks and negative earnings per share (EPS) performance.

BPS recorded that since the pandemic ended, the growth of the manufacturing industry has continued to slow:

-

4.89% in 2022

-

4.64% in 2023

-

4.43% in 2024

Ideally, as the largest contributor to GDP in terms of business activity, the manufacturing sector should grow above 5%, aligning with the overall economic growth rate.

The Bankruptcy of Textile Giant Sritex

Indonesia’s leading textile manufacturer, PT Sri Rejeki Isman Tbk (Sritex), was declared bankrupt after the Supreme Court (MA) rejected its cassation appeal. In a press release on February 3, 2025, Sritex confirmed receiving a copy of the court’s decision and stated its commitment to conducting both internal and external consolidation to safeguard stakeholders’ interests while preparing for a judicial review (PK) appeal.

The company's financial troubles date back to June 2021, when reports surfaced that it was struggling with mounting debt. Despite continuing operations, Sritex acknowledged a decline in performance due to the COVID-19 pandemic and intensified global textile trade competition. Ultimately, the Semarang Commercial Court declared Sritex bankrupt on October 21, 2024, under case number 2/Pdt.Sus-Homologasi/2024/PN Niaga Smg.

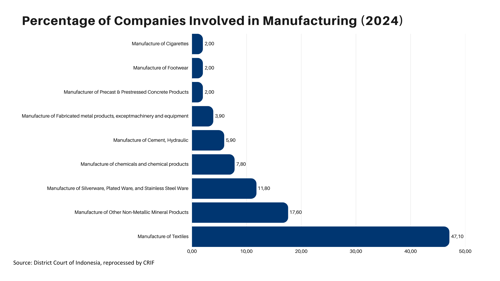

The manufacturing sector in 2024 exhibited significant variations in industries facing financial distress. Textile manufacturing recorded the highest percentage (47.1%), reflecting the industry's reliance on stable cash flow and challenges in meeting financial obligations. Other sectors with notable cases include non-metallic mineral manufacturing (17.6%) and silverware, coated equipment, and stainless steel manufacturing (11.8%).

According to CRIF Indonesia, the high number of financial distress cases in the manufacturing sector highlights the pressure faced by industries with high production costs and heavy reliance on imported raw materials. The key factors contributing to this trend include:

1. Financial Pressure from Economic Slowdown

-

The manufacturing sector is highly dependent on domestic demand and exports. With the economic slowdown and negative net export contribution, many manufacturers face operational and liquidity challenges.

-

Companies struggling with debt due to weak demand or rising production costs are more likely to seek debt restructuring as a survival strategy.

2. Heavy Dependence on Imported Raw Materials

-

Imports have grown faster than exports, increasing manufacturers' production costs. If the rupiah weakens, imported raw materials will become more expensive, adding financial strain to companies unable to pass on the costs to consumers.

-

This burden disrupts cash flow and raises the risk of financial default.

3. Impact on Investment and Production

-

The high number of distressed companies creates economic uncertainty, which makes investors more cautious about investing in the manufacturing sector.

-

With limited investment and working capital, many manufacturers face production capacity reductions, further worsening economic conditions.

Market Outlook and Strategic Solutions

In 2024, the number of cases of financial distress and insolvency recorded decreased by 7.69% compared to the previous year, with 624 cases recorded. While this may signal economic recovery, deeper analysis suggests that factors such as slower economic growth, corporate liquidity pressure, weakening industrial and trade sectors, and rising financial burdens could lead to an uptick in cases by 2025. The most affected sectors include construction, manufacturing, real estate, mining, and agriculture, with textile manufacturing being the most vulnerable.

Key risk drivers include:

-

Heavy reliance on imported raw materials

-

Exchange rate fluctuations

-

Weakened market demand due to economic slowdown

To mitigate these risks, CRIF Indonesia recommends the following strategies:

✅ Enhance financial efficiency by strengthening cash flow management, reducing reliance on short-term debt, and exploring sustainable financing alternatives.

✅ Market diversification & product innovation to reduce export dependence and remain competitive.

✅ Government support through economic stimulus measures, including tax incentives and more flexible financing access for strategic industries.

✅ Proactive debt restructuring for high-risk companies to maintain operational stability and investor confidence.

✅ Exchange rate stabilization & reducing import dependency to ease production cost pressures.

While financial distress cases declined in 2024, the risk of a rebound in 2025 remains, making it crucial for businesses and policymakers to take proactive measures to sustain economic stability and minimize disruptions.