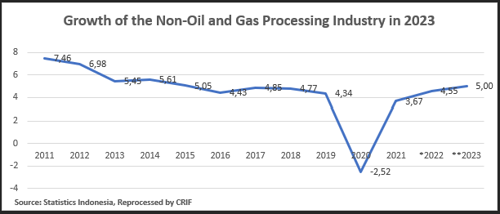

CRIF predicts that the performance of the non-oil and gas processing industry will grow by more than 5% in 2023. This is influenced by several things, including an increase in the value of exports and investment which will have an impact on the absorption of labor in the sector. This figure has increased by 0.45 points compared to its growth in 2022.

CRIF predicts that the performance of the non-oil and gas processing industry will grow by more than 5% in 2023. This is influenced by several things, including an increase in the value of exports and investment which will have an impact on the absorption of labor in the sector. This figure has increased by 0.45 points compared to its growth in 2022.

This increase was driven by the government's target for export and investment growth in 2023 where the export value of the non-oil and gas processing industry is projected to increase to USD 225 billion – USD 245 billion in 2023. This figure also increased from the 2022 target, which was USD 210.4.

In addition, the improvement in investment in the sector after the condition of the pandemic in the previous year has caused the targeted investment value to increase in 2023. Which in 2022 was only IDR 439.3 trillion, now it is targeted to reach at least IDR 450 trillion.

Of course, the increase in investment value will increase the capacity to absorb labor in the non-oil and gas processing industry sector. With an increase in investment value of around 5%, there will be absorption of additional workers that will grow positively with this increase, reaching 20.2 million people.

The Growth of the Largest Processing Industry in Indonesia

Based on data from the Ministry of Industry, the non-oil and gas processing industry sector has contributed greatly to national GDP, especially in Q2/2021, which reached 17.34%. The top two contributors from the manufacturing sector were the food and beverage industry which reached 6.66% of the total contribution and the chemical, pharmaceutical and traditional medicine industries which reached 1.96%. There are no exact figures for 2022, but it is estimated that the two industrial sectors will still be the largest contributors.

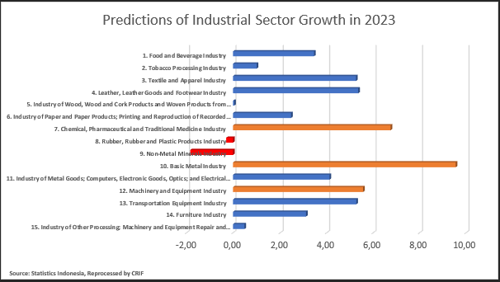

However, based on the size of the growth, there are several industrial sectors with the greater growth than the two sectors. So that these sectors are sectors that have the potential to make a large contribution in the future.

There are two that are predicted to grow high in 2023, namely the Base Metal Industry sector and the Machinery and Equipment Industry. According to the Ministry of Industry (Kemenperin), the ILMATE sector's Gross Domestic Product (GDP) growth since Q2/2021 has always been higher than national economic growth. The GDP of the ILMATE sector is a combination of the basic metal industry sector (21.7%), the metal goods industry, computers, electronic goods, optics and electrical equipment (36.1%), machinery and equipment industry that cannot be classified elsewhere (7.1%), as well as the transportation equipment industry (35.1%). Meanwhile, the ILMATE sub-sector experienced the largest GDP growth in Q2/2022, namely the base metal industry, which reached 15.79% (y-on-y).

The growth of the Basic Metals Industry is predicted to reach 9.55% (y-o-y) in 2023. This value is far higher than the predicted growth in the chemical, pharmaceutical and traditional medicine industries which only reached 6.75% (y-o-y).

Along with the improvement in the economy after the COVID-19 pandemic, the growth of the basic metal industry sector was far above the growth of other processing industry sectors. This growth is in line with policy improvements that refer to the smart supply-demand mechanism using measurable Technical Considerations in accordance with the provisions of the Minister of Industry Regulation Number 4 of 2021, and is a refinement of the Minister of Industry Regulation Number 1 of 2019 and the Minister of Industry Regulation Number 32 of 2019 with better technical criteria. The positive impact of this policy is the high annual growth in the base metal industry for the last two years, namely 11.46% in 2020 and 11.31% in 2021. (Source: Kemenperin)

In addition, the iron and steel trade balance has experienced a surplus since 2020. In the first half of 2022, the steel trade balance experienced a surplus of 107 thousand tons or USD 6.6 billion.

Another sector is the Machinery and Equipment Industry, this sector is predicted to experience an increase of 5.56%. The industrial sector is the sector that provides the second largest contribution in the ILMATE subsector after the base metal industry. In Q2/2022, the machinery and equipment industry grew by 11.22% (y-on-y). This growth was driven by increased demand for heavy equipment commodities due to the stretching business in the mining and quarrying sector.

Processing Industry Sector That is Projected to Grow Negatively in 2023

In contrast to the industrial sector which has good potential, there are 2 industrial sectors which are predicted to still experience negative growth in 2023, namely the non-metallic mineral goods industry and the rubber, rubber and plastic goods industry.

It is predicted that the non-metallic mineral goods industry will still experience negative growth in 2023, which is around -1.84%. This can be seen from the dominant quarterly growth which experienced an average decrease of -2% in 2022. This decline was still caused by low demand for these products as well as for their derivative products. In an effort to improve this sector, the Ministry of Industry continues to provide more outreach and support in the process of increasing the use of domestic products, especially the non-metallic mineral industry sector because some business people still import minerals rather than using domestic minerals.

The rubber, rubber and plastic product industry is also predicted to decline by -8.17% in 2023. The decline is quite high, seeing that in 2022 there was be a decline in demand for rubber raw material exports for the tire industry from Japan due to the sluggish economy in Japan.

There was a decline in tire manufacturing in Japan which caused a decline in demand for rubber latex exports. There has been little movement in the market on sentiment, the weak growth in factory activity in Japan was largely offset by other market factors such as rising crude oil prices. The weakening of Japanese manufacturing activity will affect the demand for rubber as a raw material for commodities. When demand falls, prices will follow.

On August 23, 2022 the price of rubber traded on the Japanese futures exchange was recorded at JPY 227.7 per kilogram, down 0.22% compared to the closing price on the previous date. (Source: Refinitiv)

In addition, the go green program which has been widely implemented in Indonesia and even the world has caused the need for plastic raw materials to decrease. Apart from the go green program, the decline was exacerbated by economic conditions in Indonesia which caused a decline in people's purchasing power for modern retail products such as non-staple food, sachet drinks, cosmetics, household appliances, automotive components, building materials, and textiles and garments. Not only that, based on data from Statistics Indonesia (BPS), even imports of plastic and plastic goods decreased by 17.49% (m-o-m) in September 2022.

In 2023, the plastics industry plans to reduce production which has started since November 2022 as a result of weak domestic market demand for products related to the sector with a decline in the range of 7.5-10%.

The Impact of the G20 on Several Non-Oil and Gas Processing Industries in Indonesia

On November 15-16, 2022, the countries leaders of the G20 Forum agreed on a joint declaration at a Summit of the Indonesian G20 Presidency which was held in Bali. During the meeting, a total of 52 points of agreement were produced which were contained in a declaration document entitled the G20 Bali Leaders Declaration.

Of the 52 points agreed upon, there are several sectors that are highlighted as supporting sectors in planning for national and world economic development. These sectors are the Information and Technology Sector, Agriculture, Health, Financial Services, Education, and Tourism.

· Information and Technology Sector

The industrial digitization program that will be carried out directly will involve players in the Information and Technology sector in the process. After the G20 declaration, it is predicted that the market potential for the IT sector will be much better. Not only from product sales, but also from after-selling services or services which have a continuous circulation chain with a more important role than the sales themselves. For small businesses, one product may only be sold, but maintenance and repair services will continue every year or even month.

· Agriculture Sector

An agricultural development research plan with a science approach will optimize the production and processing of agricultural products. The main objective of the research is to enrich the country with abundant and quality food sources with minimum production costs. This process is believed to minimize production costs, overcome pest problems, and improve product quality. The program is also expected to be able to address the old problem where product prices are not commensurate with production costs. Increasing business potential will increase the business population in the sector.

Not only there, future benefits will help in overcoming food security problems in Indonesia and even the world.

· Health Sector

Digitalization of health services can help health facilities (faskes) avoid medical negligence. Hospital Software provides features that help in managing important information from patients in real-time. Thus, medical personnel can provide treatment in accordance with the information contained effectively and efficiently.

In addition, the easier the registration and booking process can increase the opportunity for patients to consult or seek treatment at health facilities thereby increasing income for health facilities.

Not only there, future benefits will help expand its market and scope in overcoming health problems in Indonesia and even the world.

· Financial Services and Education Sector

Financial digitalization program in accelerating the expansion of financial access. Efforts to expand access to digital-based finance are accompanied by massive online financial education programs, including financial education programs for tertiary institutions and schools.

With the G20 declaration, other digitalization programs will be developed and expand the scope of financial services. As well as opening up business opportunities for financial services and consulting to remote areas online. Likewise with the Education sector where there are an increasing number of online and subscription-based educational applications and services.

· Tourism Sector

With the G20 declaration, world governments will cooperate in developing the tourism sector. This year will be the right start because Indonesia has officially relinquished its PPKM status so that people's enthusiasm for traveling is quite high. With support for this sector, in the future tourism sites will continue to grow and there will be more and more throughout Indonesia which will make domestic tourist travel routes more diverse. In addition, with the support of G20 member countries, the tourist routes to various regions of the country will be provided.

This can be a great potential for the tourism sector.

Highlighting these sectors will indirectly increase the demand for processed industrial products that support these sectors, such as gadgets and communication devices, books, medicines and chemicals, electronic devices, and others.

Therefore, in the future it is hoped that the G20 declaration will become a bridge for the Indonesian and world economies to develop even more.