The textile and textile products (TPT) industry in Indonesia plays a significant role in supporting the national economy, contributing to gross domestic product (GDP), and employing millions. However, as we enter 2024, the sector faces major challenges stemming from both domestic and global factors, from economic instability to structural issues within the industry itself. A major highlight is the impact of the bankruptcy of PT Sri Rejeki Isman Tbk (Sritex), one of Indonesia’s largest textile companies, which has further exacerbated the crisis in the textile industry.

Despite this, the government is making concrete efforts to mitigate the social and economic impacts of the bankruptcy, as well as to recover the broader textile industry. Protective policies, such as stricter import regulations, workforce training support, and the advancement of Industry 4.0 technologies, are being designed to enhance the competitiveness of local products and ensure the stability of the textile sector in the future.

The Crisis in Indonesia's Textile Industry in 2024

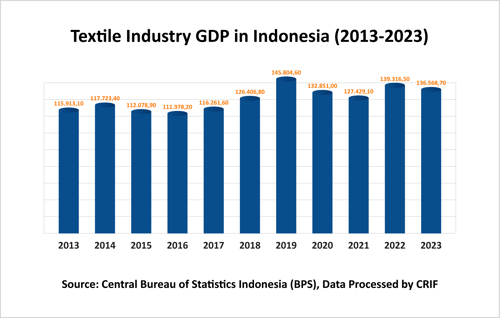

Looking at data from 2013 to 2023, Indonesia’s textile industry has experienced fluctuations in its contribution to GDP, reflecting economic challenges and shifts in market demand. Over the past decade, the average GDP contribution of the textile industry was IDR 125,667.4 billion, reaching a low point of IDR 111,978.2 billion in 2016.

A recovery trend began to emerge in 2017, with GDP reaching its peak in 2019 at IDR 145,804.6 billion, demonstrating strong performance. However, the COVID-19 pandemic in 2020 led to a sharp decline, with GDP dropping to IDR 132,851 billion. While there was a partial recovery in 2022 (IDR 139,326.5 billion), GDP slightly decreased again in 2023, falling to IDR 136,568.7 billion, indicating that the challenges in returning to pre-pandemic growth levels are ongoing.

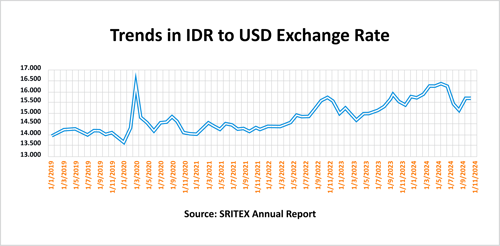

The crisis in Indonesia's textile industry intensified in 2024, particularly due to the weakening of the rupiah, which reached new lows against the US dollar. In April 2024, the exchange rate plummeted to IDR 16,210 per USD, placing a significant burden on textile companies highly reliant on imported raw materials. According to Benny Soetrisno, Chairman of Pan Brothers, approximately 60% of raw materials in this industry are priced in US dollars, meaning the weakening rupiah automatically raises production costs significantly (source: indotextiles).

From 2019 to 2024, the exchange rate between the rupiah and the US dollar fluctuated significantly, adding pressure to Indonesia's textile industry, especially due to its dependence on imported raw materials. In 2020, the COVID-19 pandemic caused a drastic surge in the exchange rate, reaching IDR 16,300 per USD in March, thereby increasing raw material import costs and further straining production. After stabilizing in 2021 and early 2022, the exchange rate climbed again, peaking at IDR 16,255 per USD in April 2024, before experiencing a slight decrease in subsequent months. This continued weakening trend worsens the challenges faced by the textile industry in maintaining low production costs.

As Soetrisno points out, about 60% of textile raw materials denominated in US dollars have now led to a significant increase in production costs for many companies. This situation, compounded by structural crises and broader economic challenges, underscores the urgency for Indonesia’s textile industry to find adaptive solutions to remain competitive in the face of increasingly difficult conditions.

Another consequence of this situation is the pressure on cash flow in textile companies due to rising raw material costs paid in US dollars. Many companies in this sector have struggled to recover from the downturn caused by the influx of cheap textile imports and price competition in the domestic market. To address liquidity problems, some companies have taken the difficult step of conducting mass layoffs. By mid-2024, around 13,800 workers had lost their jobs, particularly in factories in Central Java, such as those managed by the Sritex group.

The high rate of layoffs has also been acknowledged by the Ministry of Industry, which reported a 7.5% decrease in the number of workers in the textile and garment sector compared to the previous year. In August 2024, the number of workers in this sector shrank drastically, leaving only about 957,122 workers compared to previous years. This figure serves as an indicator of the structural challenges faced by the textile industry, which is increasingly vulnerable to global economic changes and international trade policies (source: CNN Indonesia).

From CRIF Indonesia’s perspective, the crisis impacting the textile industry reflects broader challenges faced by the manufacturing sector in Indonesia. Local industry protection policies should be accompanied by efforts to improve the competitiveness of domestic products through innovation and product diversification. With sharp fluctuations in the exchange rate and dependence on imported raw materials, the textile industry must quickly adapt to survive.

Furthermore, CRIF Indonesia believes that collaboration between the government and industry players is crucial to overcoming this crisis. Initiatives for workforce training and skill enhancement, as well as support for adopting new technologies, will be key to rebuilding consumer confidence and improving global competitiveness. These programs must be designed to meet not only short-term needs but also build a strong foundation for long-term growth.

Finally, the textile industry must recognize the shift in consumer preferences towards sustainable products. Adopting eco-friendly practices and investing in sustainability can not only capture the domestic market but also open up opportunities in the export market. By taking these steps, Indonesia’s textile industry can transform the crisis into an opportunity to build a brighter and more sustainable future.

The Bankruptcy of Sritex and Its Impact on the Industry

The bankruptcy of Sritex in early 2024 became one of the biggest issues facing the textile industry. As a long-time pillar of the sector, Sritex’s bankruptcy not only led to the loss of thousands of jobs but also shook market confidence in the sustainability of the textile industry in Indonesia. With over 50,000 employees relying on the company's operations, the potential for mass layoffs at Sritex could create significant socio-economic impacts in the Sukoharjo region of Central Java, where the company operates. As one of the key contributors to the regional Gross Domestic Product (PDRB), Sritex's closure threatens the local economic stability, which had previously benefited significantly from the textile sector.

CRIF Indonesia assesses that the causes of Sritex's bankruptcy are complex. The impact of the COVID-19 pandemic led to a global decline in demand, and the company became trapped in debt to over 20 banks. Additionally, price competition from cheaper Chinese textile products and supply chain instability caused by geopolitical tensions further exacerbated the company's situation.

Sritex Financial Performance and Causes of Bankruptcy

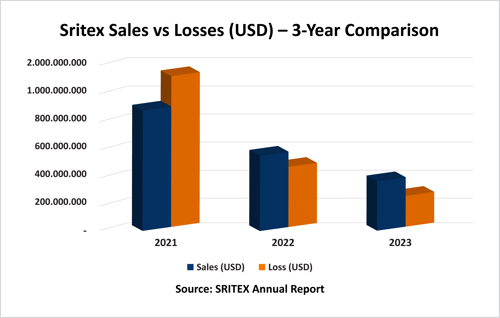

Over the past three years, Sritex’s financial performance declined significantly. In 2021, despite record sales of USD 847.5 million, the company suffered a substantial loss of USD 1.07 billion, reflecting a heavy debt burden and its inability to reach profitability. Sritex's sales continued to decline to USD 524.6 million in 2022 and USD 325.1 million in 2023, with losses also decreasing but still substantial, reaching USD 395.6 million in 2022 and USD 174.8 million in 2023. This decline in sales underscores the impact of reduced global demand, intense competition from cheap imports, and supply chain instability, making it increasingly difficult for the company to maintain profitability. Together with its high debt burden, this contributed to Sritex's bankruptcy in early 2024, which threatens the stability of Indonesia’s textile industry and poses significant risks to the economy and employment in the Sukoharjo region.

Government Response to the Crisis

In response to this crisis, the Indonesian government is seeking ways to reduce the economic and social impacts of Sritex's bankruptcy. President Prabowo Subianto has instructed four relevant ministries to immediately formulate rescue strategies aimed at reducing layoffs and protecting the sustainability of the textile sector in Indonesia. Minister of Industry Agus Gumiwang emphasized the importance of swift and effective handling to prevent this crisis from escalating and causing deeper social issues (source: Tirto.id, Goodstats).

Recovery Steps and the Future of Indonesia's Textile Industry

From CRIF's perspective, the government promptly implemented Minister of Trade Regulation (Permendag) No. 36 of 2023 concerning Import Regulations. This regulation, which was enacted on December 11, 2023, and will come into effect on March 10, 2024, is expected to invigorate the industry. One of its key aspects is the application of non-tariff trade barriers, which is crucial because, according to academics, Indonesia is one of the countries with the least use of trade barriers compared to other textile-producing countries to protect its domestic industry. This regulation is hoped to curb the influx of imported products and provide a glimmer of hope for the industry.

Another key factor for medium-term improvement is expected from a reduction in interest rates. This situation depends on the monetary policy of the US Federal Reserve, which is expected to lower interest rates in the second half of 2024. This policy will likely be followed by Indonesia, and its effects are expected to materialize next year through lower loan interest rates for business capital.

Other efforts to revitalize the textile industry include updating industrial machinery. Government support and innovation from private sector players are driving this process.

Indonesia also has abundant green energy, which is highly supportive of the sustainability of textile factories that need to consider environmental impacts. The high-end textile industry demands ESG compliance before investing, which includes using green energy sources like gas, hydro, and floating solar.