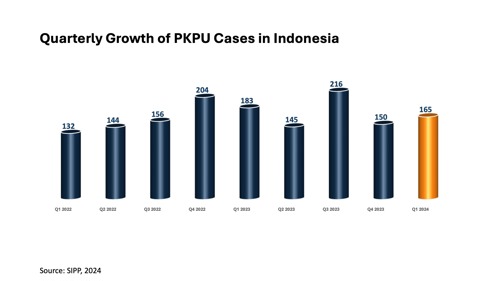

Significant Increase in Debt Payment Suspension Cases in Q1 2024

In the first quarter of 2024, the number of Debt Payment Suspension (PKPU) cases witnessed a notable increase. According to data from the SIPP of five Commercial Courts across Indonesia, PKPU applications rose to 165, marking a 25% year-on-year increase. This trend is attributed to companies still being unable to settle their debts despite showing signs of business recovery post-COVID-19, coinciding with the anticipated rebound in funding sources.

Despite this surge early in 2024, the government remains optimistic about economic improvement this year. Business leaders are encouraged to keep innovating and creatively tackling the current uncertain global economic conditions. Additionally, they should aggressively seek new export markets in 2024, as the Indonesian Chamber of Commerce and Industry (KADIN) reports high investor confidence.

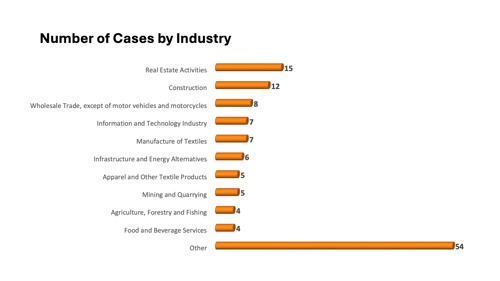

Sector-Wise Distribution of Cases

In Q1 2024, the Real Estate sector accounted for the highest number of cases with 15 cases or 9.09% of the total. The Construction sector followed this with 12 cases (7.27%), General Wholesale with 8 cases (4.85%), and various other sectors. The primary cause for these cases remains the prolonged financial impact of COVID-19, which has weakened the financial resources of companies in these sectors, making it challenging to sustain operational costs. Consequently, companies have had to resort to restructuring or shutting down.

Notable Bankruptcy Cases

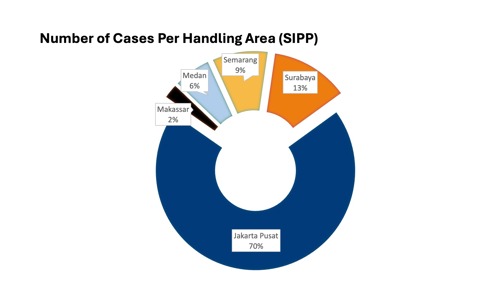

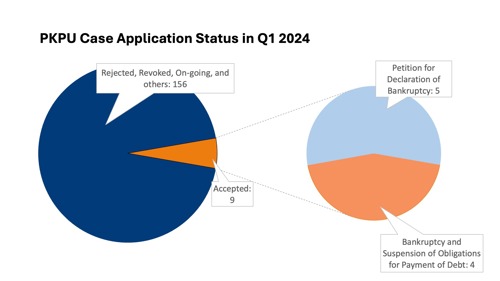

Out of the 165 applications, nine companies had their petitions accepted by the Commercial Courts. These included five cases from the Central Jakarta District Court, two from the Medan District Court, one from the Makassar District Court, and one from the Semarang District Court. Central Jakarta, handling 70% of the total cases in Q1 2024, was the most active jurisdiction, influenced by the high number of companies and intense market competition in the area.

Among the accepted cases, there were four PKPU cases and five bankruptcy cases. Three companies were declared bankrupt: PT Kertas Kraft Aceh (Persero), PT Linkadata Citra Mandiri, and PT Tata Arakamaya Mandiri.

Bankruptcy of PT Kertas Kraft Aceh (Persero)

PT Kertas Kraft Aceh (Persero) is a state-owned enterprise established under Government Regulation No. 31 of 1982, amended by Government Regulation No. 9 of 1986, in the integrated paper industry. Following a bankruptcy application on January 3, 2024, the company was declared bankrupt and ceased operations permanently. This was ratified under Government Regulation No. 17 of 2023, which governs the dissolution of companies.

The dissolution of PT Kertas Kraft Aceh was based on an assessment of the company's performance, market conditions, agility in facing market disruptions, and its ability to continue business activities. The company struggled with supply chain issues, including inadequate and overpriced pine and gas fuel supplies, hindering production processes.

Government Regulation No. 17 of 2023, signed on April 3, 2023, outlines the liquidation process for PT Kertas Kraft Aceh, to be completed within five years from the enactment date.

PKPU Petition Against State-Owned Indofarma (INAF)

The list of problematic State-Owned Enterprises (BUMNs) is growing, with PT Indofarma Tbk (INAF) facing allegations of financial management manipulation. The Supreme Audit Agency (BPK) found irregularities indicating criminal acts by related parties in INAF's financial management. This includes suspected financial report manipulation, adding to INAF's woes. Previously, INAF faced a PKPU petition from PT Foresight Global, filed at the Central Jakarta Commercial Court (case No. 74/Pdt.Sus-PKPU/2024/PN.Niaga.Jkt.Pst) on February 29, 2024.

On March 28, 2024, the Central Jakarta Commercial Court granted a provisional PKPU for INAF for 42 days. This was extended on May 8, 2024. As of September 2023, INAF owed Rp 6.63 billion to Foresight Global, recorded as third-party debt. INAF has not been able to confirm funds for settling the PKPU claim, which is their second PKPU petition. The first, from PT Tjahaya Inti Gemilang, was rejected by the Central Jakarta Commercial Court on February 29, 2024, due to insufficient proof of debt maturity and collectibility.

INAF's issues extend beyond PKPU cases, with delayed employee salary payments for March 2024. INAF's financial performance for 2023 remains unreported, but as of Q3 2023, the company recorded a net loss of Rp 191.69 billion, up 4.69% year-on-year from Rp 183.11 billion in the previous year, due to a 50.74% drop in net sales.

Economic Caution Needed Amid Rising PKPU Cases

With the significant increase in PKPU cases in early 2024, CRIF Indonesia emphasizes the need for heightened economic vigilance by both the government and business actors in Indonesia. The impact of a sluggish economy is evident through various factors, one of which is a wave of layoffs (PHK) within the country, particularly in labor-intensive manufacturing sectors. The number of layoffs is predicted to reach between 50,000 and even hundreds of thousands of workers since the beginning of 2024.

This wave of layoffs is not merely a matter of workforce efficiency. It is also a consequence of factory closures by companies unable to sustain operations and compete in the domestic market, despite ongoing consumer activity. These layoffs will lead to a decline in consumer purchasing power, which will subsequently affect Indonesia's economy. Therefore, the government must act swiftly and implement strategies to support the struggling manufacturing industry.