As the second tropical country with the largest land forest area, Indonesia has recorded significant growth in the forestry sector, achieving a rate of 2.61%. The star product in the wood category is acacia, which accounts for 45.6% of total wood production, while non-timber forest products are led by paper and pulp, with export volumes exceeding 4 million tons annually.

Recognizing the global role of the forestry sector and wood products, Indonesia, as the Lead Country of the ASEAN Working Group on Forest and Climate Change (AWG-FCC), reiterates the strategic importance of forests in combating climate change. Southeast Asia is home to about 15% of the world's tropical forests, making ASEAN a vital player in addressing global climate change through its forestry sector. Geographically, 45% of the world's forest area is located in tropical regions. The larger a country's forest area, the more forest products can be utilized to meet human needs.

Additionally, forests act as significant climate controllers at both regional and global levels. They serve as natural carbon sinks and are the most important terrestrial biomass reservoirs. Therefore, forest areas hold immense value for biodiversity, ecosystem services, social and cultural identity, livelihoods, as well as climate change adaptation and mitigation.

This was conveyed by the Delegation of the Republic of Indonesia (DELRI) during the 20th AWG-FCC meeting, held virtually by Malaysia on Thursday, May 16, 2024. The meeting was led by Wahyu Marjaka, Director of Sectoral and Regional Resource Mobilization (MS2R) of the Directorate General of Climate Change Control (PPI) at the Ministry of Environment and Forestry (KLHK).

Development of the Forestry Sector's Contribution to Indonesia's GDP

In 2024, Indonesia's forestry industry faces significant challenges. However, these are balanced by substantial opportunities as global awareness of environmental sustainability increases. With its abundant tropical forests, Indonesia plays a crucial role as a major provider of forest resources, including timber, non-timber products, and their derivatives.

Pressures from climate change, deforestation, and unsustainable natural resource exploitation require a new approach to ensure that forest utilization meets economic needs while also preserving ecosystems and biodiversity.

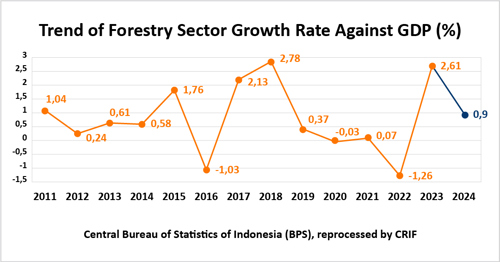

Data from the Central Bureau of Statistics of Indonesia (BPS), processed by CRIF, indicates that forestry sector growth declined over the past five years (2018-2022), reaching a low of -1.26%, before rebounding to 2.61% in 2023. This decline was due to operational limitations during the pandemic, with improvements occurring as market conditions stabilized. Given the unpredictable market, ongoing deforestation, and historical trends, forestry sector growth is projected to decrease to 0.9% in 2024, with fluctuations expected in the coming years.

Current factors influencing the development of the forestry sector include:

-

Limited contribution of production forests to the enhancement of biological and non-biological forestry products.

-

Restricted strategic roles that production forests can play in energy development policies.

-

Declines in the performance and output of natural and plantation forests.

-

Decreased utilization of timber from natural and active plantation forests compared to the baseline year of 2019. The performance of tree planting has not reached targets for significantly increasing plantation forest production, resulting in diminished competitiveness for the forestry sector in the global market.

-

Continuous decline in the contribution of natural and plantation forests to GDP formation and job creation.

The Condition of Indonesia's Forestry Sector in the Eyes of the World

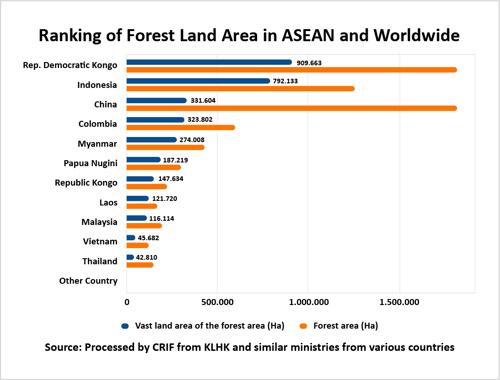

As of 2022, Indonesia's forest area spans 125,793.18 thousand hectares, with 62.97% of this being land area. This positions Indonesia as the tropical country with the largest land forest area in ASEAN and the second largest in the world, after the Democratic Republic of the Congo.

The vast land area of Indonesia's forests creates expectations for higher forest yields and a wider variety of products compared to smaller countries. This serves as a significant attraction for both businesses and consumers in the global forest product market.

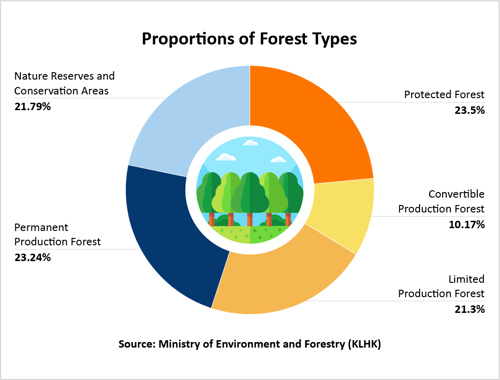

From this area, several types of forests contribute the following proportions to Indonesia's total forest area:

-

Five main types of forests account for between 20-25% of the total forest area, with one type, “convertible production forest,” making up only 10.17% of the total forest area, half the size of other forest types.

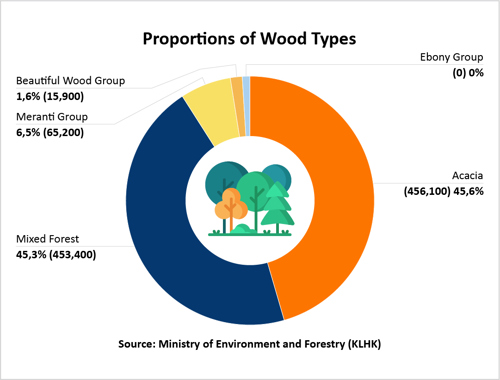

In terms of timber production, there are five main species, with acacia and mixed jungle accounting for the largest share, reaching 45% of total roundwood production in 2023.

With high acacia production, Indonesia is one of the countries attracting attention as a major supplier of this wood type. Acacia is popular as a construction material and fuel in various countries. Its durability makes it highly valued for construction and furniture needs. Additionally, acacia provides environmental benefits, including reforestation, erosion control, and community empowerment. Countries interested in this type of wood include China, Germany, Japan, India, EU nations, and those in the Middle East.

International Trade in the Forestry Sector

The Ministry of Environment and Forestry (KLHK) reports that Indonesia's forestry export performance shows a positive trend in 2024 despite a global market characterized by geopolitical and economic uncertainties. The superior quality and exclusive value of each fiber of tropical wood, alongside other forest products, position Indonesia as a key player in the global market.

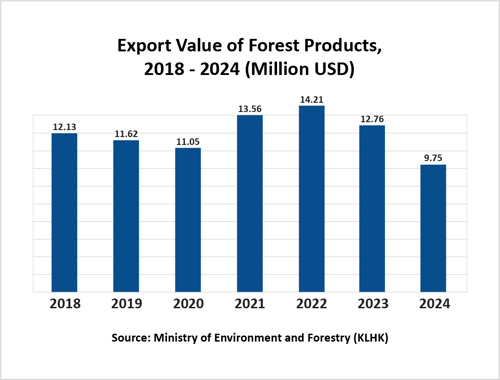

According to data from the Central Bureau of Statistics (BPS), Indonesia's forestry product exports reached 17.19 million tons in 2023, an increase of 9.03% from 15.77 million tons in the previous year. While export volumes have increased, the export value declined by 10.20%, from USD 14.21 billion in 2022 to USD 12.76 billion in 2023. These figures reflect the dynamic and responsive nature of the global market to demand. For 2024, the data is still being compiled as of September 2024.

The export data for forestry products is based on the issuance of V-Legal documents and FLEGT licenses (for the European Union), which confirm the legality of wood and wood products for export. These documents are also required for submitting Export Goods Notifications by exporters of wood products by legal regulations. This documentation is issued each time an exporter proceeds with an export process and is verified by an Independent Verification Assessment Agency (LPVI) once the exporter meets the standards of the Timber Legality and Sustainability Verification System (SVLK) and obtains S-Legalitas.

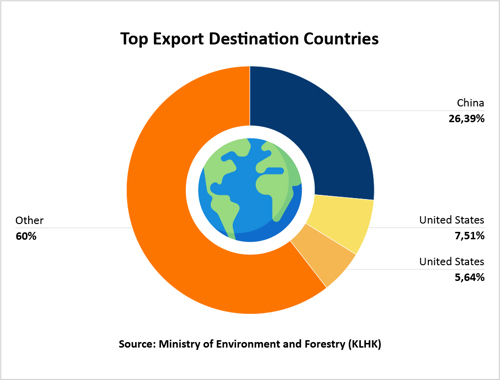

China remains the primary destination for Indonesia's forestry products, with export values reaching USD 5.8 billion (IDR 88.13 trillion) in 2023, accounting for 26.39% of total exports. The trade relationship continues to flourish like a symbiotic bond. The United States and Japan are also important, with respective export values of USD 1.65 billion and USD 1.24 billion, further solidifying Indonesia's position in the global market.

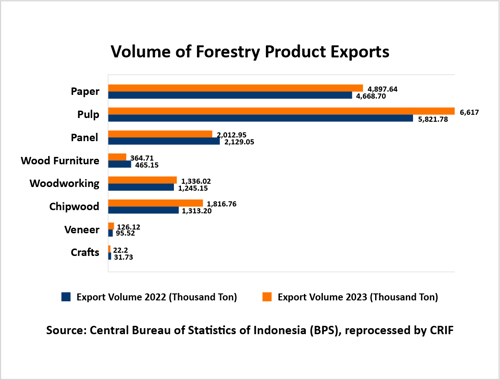

Among forest products, paper stands out as a key player. With export volumes reaching 4.90 million tons and a value of USD 4.31 billion in 2023, a 4.9% increase in volume reflects stable global demand for Indonesian paper. Meanwhile, pulp exports surged by 13.66%, reaching 6.62 million tons in 2023. However, declining prices in the global market led to a 7.17% decrease in its export value, reminding us that growth is often accompanied by challenges.

As for wooden furniture, a significant attraction among forest products, the volume and value of exports fell sharply in 2023 by 21.59% and 24.61%, respectively, totaling USD 1.49 billion. Despite this decline, Indonesian furniture products remain sought after in the global market, particularly in China. With quality raw materials like teak and mahogany, furniture exports reached 1.8 million tons valued at USD 2.7 billion (IDR 41.1 trillion, with an exchange rate of USD 1 = 15,915) in 2023, up from 1.4 million tons over the past three years since 2020.

Thus, the paper and furniture industries significantly contribute to foreign exchange, amounting to IDR 231 trillion, a 12% increase from the previous year. This growth brings a breath of fresh air to the economy, providing Indonesia with much-needed resilience amidst global economic challenges. Sustainable forest management remains the foundation to ensure that, in addition to generating foreign exchange, Indonesia's forests are preserved for future generations.

Despite the forestry sector experiencing a decline over the past five years, the recovery observed in 2023 indicates potential for renewed growth, especially as the global market begins to stabilize. The dominance of acacia, coupled with strong global demand, highlights Indonesia's competitive advantage in this sector and presents substantial export opportunities. Therefore, the issue of deforestation must be addressed promptly. The pressures from deforestation and unsustainable exploitation underscore the need for a new approach to forest resource management. Achieving a balance between economic utilization and ecosystem conservation is crucial for the future, influencing the development of the supply chain in the processed wood products industry.

CRIF Perspective: Navigating Opportunities in Indonesia's Forestry Sector

As Indonesia's forestry sector faces both challenges and opportunities, business leaders and investors must adopt a proactive approach to capitalize on the evolving landscape. One of the foremost recommendations is to prioritize sustainability by implementing certified sustainable forestry management practices. This shift not only aligns with global market trends favoring sustainable sources but also enhances the credibility of businesses in an increasingly environmentally conscious market. Additionally, leveraging digital solutions can streamline operations, improve supply chain transparency, and facilitate compliance with stringent regulations, ultimately opening doors to new market opportunities.

Moreover, focusing on value-added products, such as processed wood and innovative packaging solutions, will enable businesses to meet the rising demand while increasing profit margins. Companies should also invest in comprehensive market research to understand shifting consumer preferences and tailor their offerings accordingly. Forming strategic partnerships with local stakeholders and engaging in advocacy for supportive policies will enhance credibility and drive collective progress toward sustainable forestry initiatives. By embracing these strategies, businesses can thrive in Indonesia's forestry sector and contribute to a sustainable future for the industry and the environment.