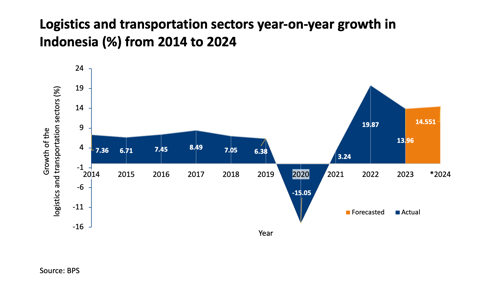

The Transportation and Logistics sector is a cornerstone of Indonesia's economy, especially during its recovery from the Covid-19 pandemic. This sector must remain robust, well-planned, and well-maintained to support business activities and drive the development of other sectors. Despite government efforts, Indonesia's Transportation and Logistics sector experienced a 4.91-point decline, with a year-on-year (Y-o-Y) growth rate dropping to 13.96% from the previous year's 19.87% (Y-o-Y).

This decline is attributed to several factors, including the relatively high logistics costs compared to other countries. As a result, potential demand has not fully translated into actual demand. Notably, Indonesia's logistics costs accounted for 23.5% of GDP in 2021, decreasing to 22% at the beginning of 2023. These figures are still high compared to ASEAN countries like Malaysia, where logistics costs are only 13% of GDP.

Indonesia's Position in the Global Logistics Sector

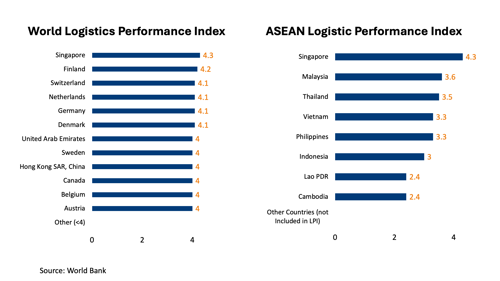

The World Bank uses the Logistics Performance Index (LPI) to benchmark countries' logistics sectors.

In 2023, Indonesia's LPI ranking dropped significantly by 17 places to 63rd, down from 46th in 2018, with its score decreasing from 3.15 to 3.0. Among the eight ASEAN countries, only three improved their rankings: Singapore, which climbed six positions to secure the top spot, the Philippines, which rose by 13 places, and Malaysia, which advanced by 10 places. Indonesia now ranks 6th in ASEAN, below Singapore, Malaysia, Thailand, Vietnam, and the Philippines.

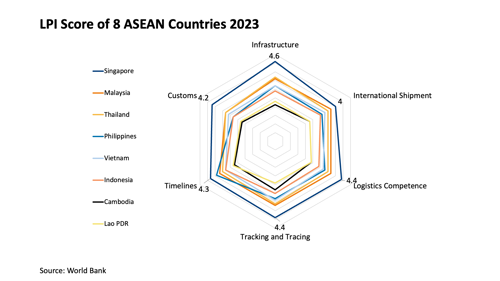

Comparison of Indonesia's LPI with Other ASEAN Countries

Singapore leads in all six assessment aspects of the LPI: Customs, Infrastructure, International Shipment, Logistics Competence, Tracking and Tracing, and Timeliness, with scores ranging from 4.0 to 4.6. Indonesia, with scores between 2.8 and 3.3, still ranks above the average for upper-middle-income countries, which have an average score of around 2.54. However, compared to high-growth partner countries like China (score 3.7, rank 19) and India (score 3.4, rank 47), as well as ASEAN countries like Singapore (score 4.14, rank 1), Malaysia (score 3.43, rank 32), and Thailand (score 3.26, rank 45), Indonesia needs to improve its logistics performance significantly.

Several Indonesian experts, including the Coordinating Minister for Maritime Affairs and Investment, argue that the LPI assessment by the World Bank is not balanced. They note that Indonesia, as a "final destination" country, cannot be compared to Singapore, a "transshipment hub." They suggest that the World Bank should consider additional factors, such as Indonesia's status as the world's largest archipelago with over 17,500 islands, which presents unique logistical challenges. Indonesian experts have invited the World Bank to discuss these issues to address and improve Indonesia's logistics performance.

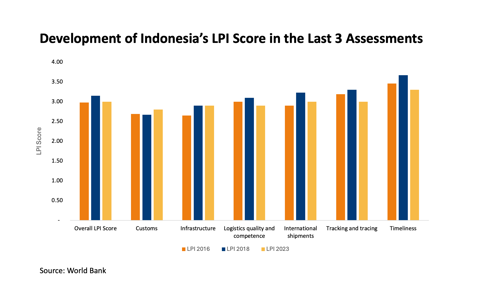

Indonesia's Logistics Development Over the Last 3 Years

Indonesia's logistics performance has declined despite claims of its port infrastructure being among the world's top 20. In 2023, Indonesia's LPI ranking fell 17 places from its position in 2018, with its score dropping from 3.15 to 3.00, placing it 63rd globally. Within ASEAN, Indonesia's logistics performance lags behind countries like Singapore, Malaysia, and Thailand. The World Bank evaluates logistics performance based on six indicators: customs, infrastructure, international shipments, logistics quality and competence, tracking and tracing, and timeliness. Indonesia only improved the customs and excise index (2.80) and the infrastructure index (2.90).

Indonesia's logistics quality and competence score declined to 2.90 from 3.10 in 2018, highlighting the need to improve logistics quality and competence. The score for international shipments also deteriorated, falling to 3.0 from 3.23 in 2018, indicating a decrease in shipping speed, transport infrastructure quality, logistics services, and administrative ease. For instance, Indonesia's average port processing time is 1.1 days, compared to 1.0 days in Malaysia, 0.8 days in China, and 0.9 days in India.

The tracking and tracing score declined from 3.30 in 2018 to 3.00 in 2023, indicating the need for improvements in tracking systems, information accuracy, and access speed. Additionally, the timeliness component saw a drastic decrease to 3.00 from 3.67 in 2018, illustrating the need for serious attention to delivery times, document processing, shipment duration, and adherence to schedules. For example, Indonesia's average postal delivery time was 13.3 days in 2019, longer than India's (10.4 days), Malaysia's (5.2 days), and China's (5.6 days). However, Indonesia has improved import activity dwelling time, averaging 3.2 days, better than the 2018 LPI average of 4 days.

Despite these challenges, coordinated efforts for improvement between the government, relevant agencies, and business operators could enhance Indonesia's logistics performance. These improvements will contribute to Indonesia's competitiveness in global logistics.

Subsector Developments in Indonesian Logistics

Geopolitical tensions and global market fluctuations could impact Indonesia's economy, including import pressures and soaring logistics costs. Factors affecting global markets include tensions in the Red Sea and the shallowing of the Panama Canal.

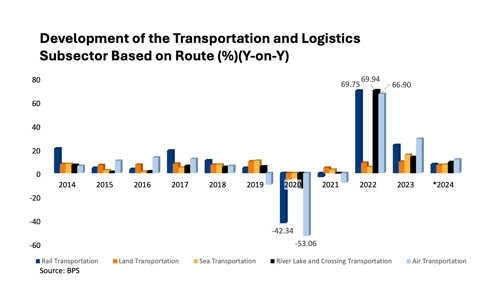

The development of Indonesia's logistics sector is closely linked to transportation and warehousing activities. While these include passenger transportation, the majority of contributions come from logistics activities. Significant growth was observed in 2020 and 2022. In 2020, the sector saw substantial declines due to government lockdowns and large-scale social restrictions (PSBB) to address the COVID-19 pandemic. The Rail Transport and Air subsectors experienced the highest declines, 42.34% and 53.06% respectively, while other subsectors saw declines below 18%.

In 2022, as pandemic conditions improved, the logistics subsector began to grow again. The Rail Transport subsector grew by 69.75%, Inland Water Transport and Ferries by 69.94%, Air Transport by 66.90%, and Warehousing and Transport Support Services by 40.54%. The remaining subsectors saw increases of less than 9%.

Increased industrial activities in Indonesia and enhanced capabilities through process standardization, technology, and human resources development (HRD) contributed to this growth. Improved services through collaboration among logistics providers, cooperation between logistics service providers and users, and between logistics service providers and logistics facility operators have also played a significant role.

Government Breakthrough in Logistics

The government must ensure smooth production and distribution in the global supply chain while being aware of external uncertainties. Factors such as raw material shortages, rising energy prices, and increasing logistics and transportation costs need to be addressed. Additionally, the government must anticipate increased demand for certain goods like electronics, motor vehicles, and medical equipment.

Since the onset of the COVID-19 pandemic, global container shipping costs have risen significantly, affecting trade and logistics. High shipping costs have also impacted the prices of goods, resulting in decreased competitiveness. To strengthen logistics performance, various breakthroughs are needed. Digital technology development can make logistics activities more efficient through integrated digital logistics systems, data analytics, and cloud computing.

The National Logistics Ecosystem (NLE) needs to be designed and implemented robustly. NLE integrates the flow of goods and documents internationally, from the arrival of transport facilities to the arrival of goods at warehouses. Digitalizing logistics business processes must involve all stakeholders, including logistics actors, service providers, and the government, facilitated through an integrated internet network system.

By addressing these challenges and leveraging technology, Indonesia can improve its logistics performance and enhance its competitiveness in the global logistics sector.