Indonesia, the world's largest archipelago, has immense marine and fisheries potential. As one of the top global producers, Indonesia's marine and fisheries sector plays a crucial role in the sustainability of the global ecosystem. With a production capacity of 24.7 million metric tons, Indonesia ranks between China (68.7 million metric tons) and India (16.2 million metric tons).

Key potentials of Indonesia's marine and fisheries sector include:

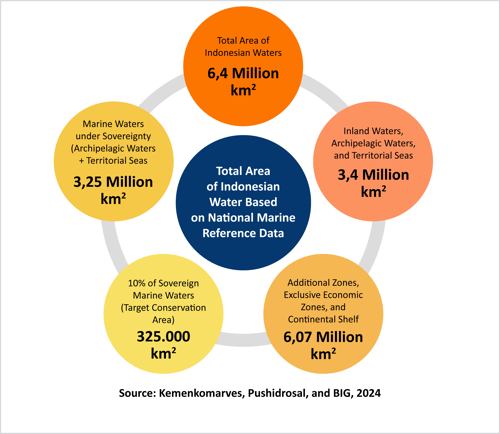

2. Expansive Marine Waters Indonesia's vast marine areas cover 6.4 million km², including inland and territorial waters, additional zones, exclusive economic zones, and continental shelves, with potential for extensive productive use.

2. Rich Marine Resources covering approximately 62% of its territory, Indonesia's marine resources include diverse commodities such as sea fish (skipjack, tuna, grouper, mackerel, snapper), shrimp (vannamei, tiger), seaweed (Eucheuma, Gracilaria), shellfish (green mussel, blood clam), ornamental fish, and other marine products. These commodities are crucial for both domestic consumption and export.

According to the Central Bureau of Statistics in 2022, the top freshwater commodities were tilapia (1.356 million tons), catfish (1.102 million tons), and milkfish (779.7 thousand tons). In marine commodities, seaweed dominated with 9.234 million tons, followed by shrimp (918.6 thousand tons) and mackerel (660.5 thousand tons). Despite tilapia's high production volume, shrimp commands a higher market value, reaching IDR 75.4 trillion compared to tilapia's IDR 35.1 trillion.

3. Marine and Fisheries Entrepreneurs in 2024, there were 1.894 million businesses, with 1.703 million registered with the Ministry of Marine Affairs and Fisheries. The businesses comprise corporate entities, individual ventures, and supporting enterprises, showing a 10% increase from 2023. The primary business hubs include Central Java (12.03%), East Java (9.96%), South Sulawesi (8.08%), and West Java (6.54%). The industry is primarily focused on fish capture (54.85%) and fish cultivation (35.29%).

4. International Trade Indonesia's marine products are pivotal in global food security, reducing reliance on other protein sources. Apart from fish and shrimp, Indonesia's seaweed is renowned globally for its applications in food, cosmetics, pharmaceuticals, and bioenergy.

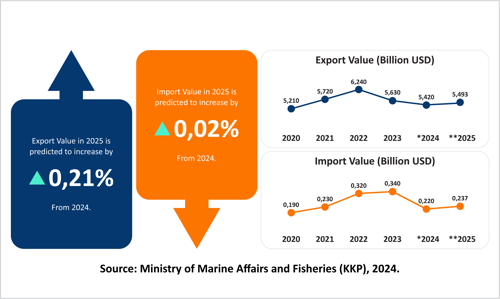

Despite a 13.14% decline in export value from 2022 to 2023, reaching USD 5.42 billion in 2024, the increasing per capita consumption indicates a growing demand. Factors affecting export-import strength include export-import regulation plans, price fluctuations influenced by China, and international trade negotiations. The primary export destinations are the U.S. (USD 889.39 million), China (USD 556.04 million), ASEAN (USD 353.93 million), Japan (USD 285.47 million), and the EU (USD 193.35 million).

EXPORT AND IMPORT ACTIVITIES OF MARINE AND FISHERIES COMMODITIES

Indonesia's marine and fisheries products have a significant impact on the global market, not only in terms of export volume but also in the quality and diversity offered. Sustainable management of marine resources is key to maintaining Indonesia's position as a leading player in the international market.

Since 2022, the export value of Indonesia's marine and fisheries commodities has continued to decline, dropping by 13.14% in 2023. Preliminary figures for 2024 show a decrease to USD 5.42 billion. The increasing per capita consumption volume each year indicates a growing demand for fishery products. However, the declining import value suggests a decrease in demand or a drop in market prices for imported products in Indonesia.

Several factors influencing Indonesia's export and import strength include:

-

The downstream plan and export-import regulations proposed by the President.

-

Price fluctuations are driven by China, the world's largest supplier and key competitor.

-

International trade negotiation systems.

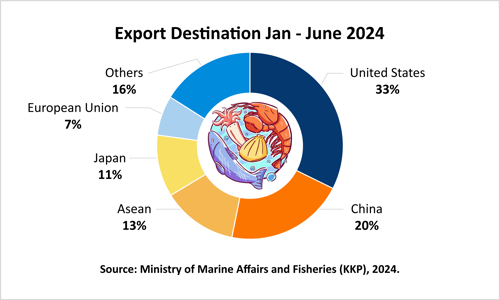

EXPORT DESTINATIONS OF MARINE AND FISHERIES COMMODITIES

The United States remains the main export destination for Indonesian fisheries products, with an export value of USD 889.39 million, followed by China (USD 556.04 million), ASEAN (USD 353.93 million), Japan (USD 285.47 million), and the European Union (USD 193.35 million). Compared to the same period in 2023, exports to the United States and Japan have declined, while exports to China, ASEAN, and the European Union have increased.

MAIN CHALLENGES

Despite its potential, Indonesia's fisheries sector faces significant challenges, especially in technology:

-

Technological Innovation and Research Countries like Japan, Norway, and South Korea excel in advanced research and development. Indonesia's R&D in fisheries remains limited, affecting efficiency and competitiveness.

-

Monitoring and Resource Management Advanced systems in Canada, Australia, and Europe use sophisticated monitoring technologies. Indonesia's implementation of satellite-based monitoring and GIS for tracking illegal fishing and resource sustainability is not yet optimal.

-

Processing Technology While Japan and the Netherlands use advanced processing technologies, Indonesia still relies on simpler methods, though there have been improvements in frozen fish processing and packaging.

Further issues include insufficient infrastructure support in remote areas, limited use of renewable resources in fisheries, and low youth participation in the sector.

CRIF INSIGHT AND RECOMMENDATIONS

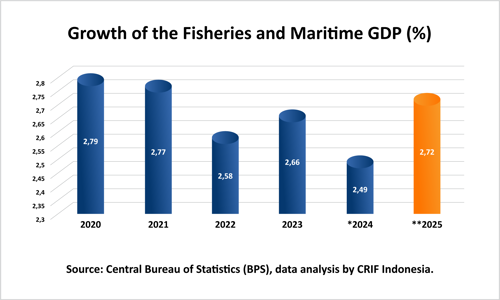

CRIF projects a 2.72% GDP growth in the fisheries sector by 2025, indicating promising prospects. However, technological and systemic enhancements are essential to improve product quality and negotiate better in international markets.

Investment opportunities are ripe in Central Java, East Java, South Sulawesi, and West Java, based on the concentration of fishery commodity trade. Other regions with less than 4.30% share can also be targeted for investment due to their untapped production potential.