The sugar sector is a vital pillar of Indonesia's economy, contributing significantly to the national Gross Domestic Product (GDP) and food security. However, efforts to achieve self-sufficiency in sugar production by 2028 face complex challenges, ranging from low productivity and outdated infrastructure to dependence on imports. Exacerbated by corruption scandals tarnishing the sector's governance, these challenges demand comprehensive solutions and strategic approaches. This article will delve into the key obstacles, their impact on the industry, and actionable steps to realize sugar self-sufficiency as part of building sustainable food security.

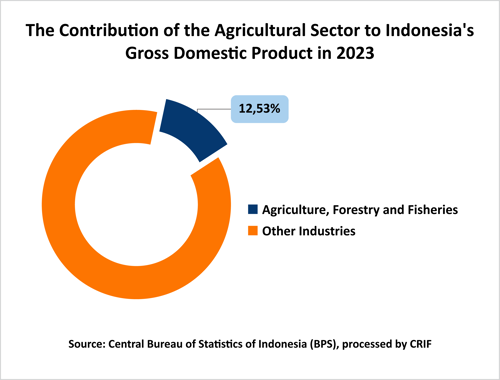

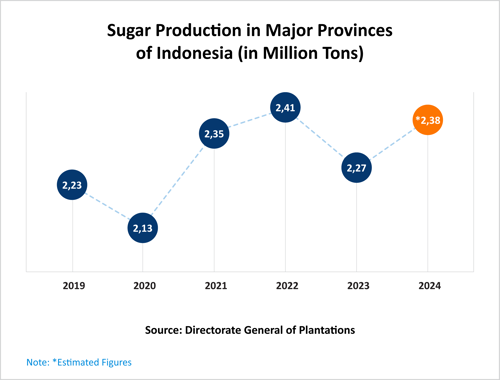

As an integral part of the agricultural sector, which contributes 12.53% to Indonesia's national GDP, the sugar sector faces significant hurdles on its path to achieving self-sufficiency by 2028. Although national sugar production is projected to rise to 2.38 million tons by 2024, various constraints—including low sugarcane productivity, outdated factory technology, and high dependence on imports—continue to impede the sector's progress. Additionally, the decline in household sugar consumption from 6.32 kg per capita annually in 2022 to 5.80 kg per capita in 2023 adds another layer of complexity to the problems faced.

The path toward self-sufficiency is further threatened by allegations of corruption in sugar imports involving Tom Lembong, a former Trade Minister for the 2015–2016 period. These corrupt practices have destabilized prices, deepened reliance on imported sugar, and disrupted the sugar industry ecosystem. This case not only inflicts financial losses on the state and farmers but also erodes public trust in the governance of the food sector. If left unaddressed through transparent and accountable policies, the long-term impacts could jeopardize national food security.

With robust synergy and a scientific approach, the vision of sugar self-sufficiency can still be achieved as a strategic step toward sustainable food security.

Contribution of the Sugar Sector to the National Economy

The agricultural sector continues to serve as the backbone of Indonesia's economy, contributing 12.53% of the national Gross Domestic Product (GDP) in 2023, equivalent to IDR 2.62 trillion (very preliminary figures, BPS). Among its subsectors, sugar plays a vital role in supporting food security and serving as a source of employment. With sugarcane plantations spanning 504,776 hectares, national sugar production in 2023 reached 2.27 million tons and is projected to increase to 2.38 million tons in 2024 (Sugar Trade Performance Analysis, PUSDATIN).

However, domestic sugar consumption levels are showing a declining trend. Data reveals that household sugar consumption per capita decreased from 6.32 kg annually in 2022 to 5.80 kg in 2023. This decline serves as a wake-up call for the government to strengthen strategies for managing the sugar sector, especially in light of the self-sufficiency target set for 2028.

Dynamics of Sugarcane Plantations: Land Availability Challenges and the Direction of National Sugar Policies

Indonesia has long aimed for self-sufficiency in sugar production. Initially, the government set a target for 2020, later revising it to 2024. However, due to the current realities, the target has again been postponed to 2028 for consumption sugar and 2030 for industrial sugar, as outlined in Presidential Regulation Number 40 of 2023 signed by President Jokowi. The regulation maps out a roadmap for sugar self-sufficiency, targeting an increase in sugarcane productivity to 93 tons per hectare and expanding plantation areas by 700,000 hectares, partially sourced from forest lands.

The current challenge in the sugarcane/sugar commodity lies in securing large-scale new lands suitable for sugarcane cultivation. The ambitious target of opening 700,000 hectares—more than double the existing area—requires a significant expansion of sugar mills. Currently, there are only 62 mills, comprising 43 state-owned and 19 private mills, according to data from the Directorate General of Agro-Industry, Ministry of Industry (Kumparan, 2024). Additionally, existing sugarcane fields exhibit low productivity, averaging only 60 tons per hectare. A key issue is the low sugar yield (the percentage of sugar extracted per quintal of sugarcane), which has exacerbated Indonesia’s dependence on sugar imports.

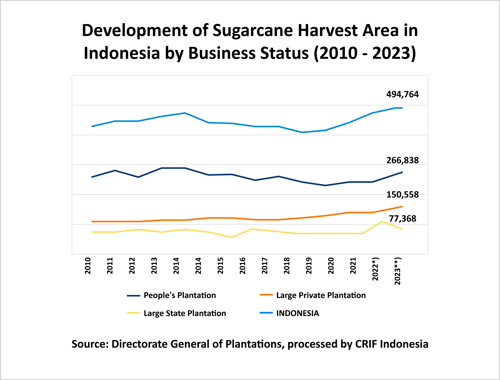

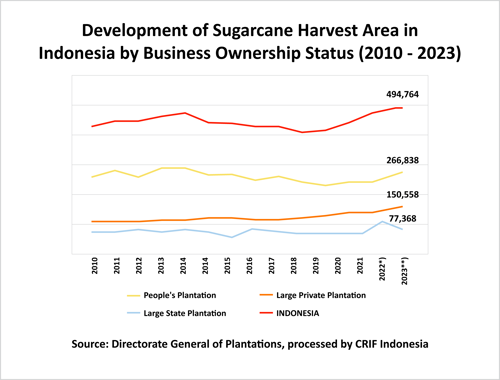

Building an efficient sugar industry necessitates a comprehensive policy framework that ensures clear linkages and alignment among policies, creating an integrated system capable of achieving shared objectives. However, expanding sugarcane plantations in Indonesia faces challenges due to limited suitable land availability, compounded by competition with other staple crops, particularly rice and secondary crops. This is evidenced by the stagnant growth of harvested sugarcane areas over the past decade (2014–2023), which increased by an average of only 0.51% per year.

During the 2014–2023 period, smallholder plantations saw a 0.63% annual decrease in harvested sugarcane area, while state-owned plantations increased by 3.63% annually and private estates by 3.77% annually.

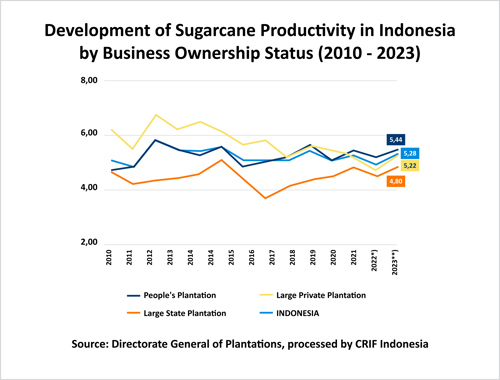

In terms of national sugarcane productivity—calculated as the ratio of sugar production to harvested area—productivity over the past decade (2013–2023) has been highly volatile across plantation types. Sugarcane productivity is influenced by external factors as well as cultivation practices. During this period, smallholder plantations experienced an average productivity growth rate of 0.70% per year, state-owned plantations grew by 1.02% per year, while private estates saw a decline of 2.08% per year.

Trade Imbalance in Indonesia's Sugar Sector: Domestic Needs vs. Surplus Exports of Molasses and Crystal Sugar

Indonesia's sugar trade highlights a contrast between the export of molasses (HS Code 1703) and the import of crystal sugar (HS Code 1701). Crystal sugar or sucrose crystallized sugar, plays a vital role in achieving national sugar self-sufficiency. Ensuring crystal sugar production meets target levels is critical to minimizing dependency on imports.

Molasses, a by-product of sugar processing containing 48–55% sucrose, has various applications, from MSG production to ethanol and alcohol manufacturing. Additionally, it serves as an additive in animal feed. Surplus domestic molasses, which remains underutilized, is exported.

Export-Import Trends of Molasses

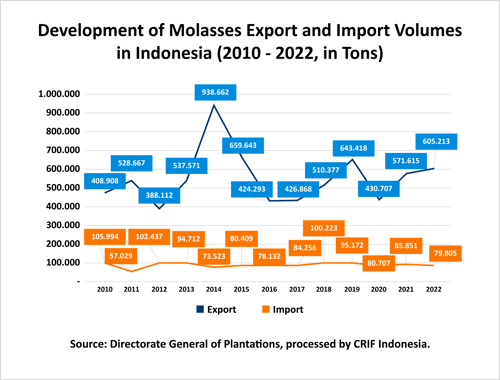

Since the 1980s, Indonesia has been exporting molasses to several countries. Over the past decade (2013–2022), Indonesia’s molasses exports averaged 574.84 thousand tons annually, worth approximately USD 78.09 million, with an average annual growth rate of 9.96%. The highest export volume was in 2014, reaching 938.66 thousand tons (up 74.61% from the previous year). By 2022, molasses exports reached 605.21 thousand tons, valued at USD 104.56 million.

The surplus in Indonesia’s molasses trade balance has consistently increased, averaging 14.58% growth per year over the last decade. In 2022, the surplus reached USD 80.52 million, a 3.28% increase from 2021.

Crystal Sugar Imports and Trade Deficit

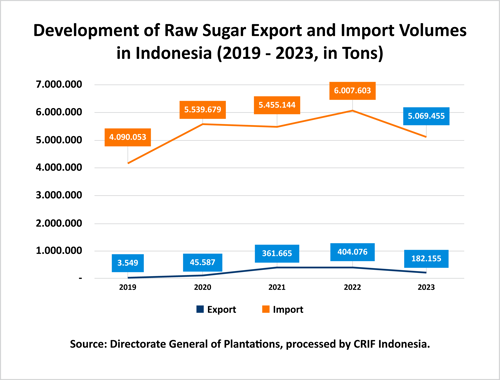

Crystal sugar imports remain essential to meet Indonesia's domestic consumption and industrial needs due to insufficient local production. Over the past five years (2019–2023), the sugar trade balance has been in deficit, with import volumes and values far exceeding exports. The largest trade deficit occurred in 2023, with an import volume of 4.89 million tons worth USD 2.75 billion.

Recommendations for Reducing Trade Imbalances

To address increasing sugar imports and enhance domestic production, CRIF Indonesia suggests several strategic measures:

-

Infrastructure Revitalization: Modernizing sugar mills and adopting more efficient processing technologies.

-

Seed Quality Improvement: Enhancing the quality of sugarcane seeds to boost productivity.

-

Government-Industry Collaboration: Strengthening partnerships with farmers and the sugar industry.

-

Financial Support: Expanding programs such as Kredit Usaha Rakyat (KUR) to provide funding for sugarcane cultivation and processing.

By implementing these steps, Indonesia can optimize its agricultural sector, reduce its sugar trade deficit, and move closer to achieving its sugar self-sufficiency goals.

Revitalization of Sugar Mills and Land Extensification Planning

The Ministry of Agriculture (Kementan) has allocated IDR 43.1 billion until 2025 to support the goal of achieving self-sufficiency in sugar production by 2028. These funds will be used for sugarcane land intensification programs, including ratoon care and ratoon renewal activities. Ratoon care involves intensive maintenance of ratoon sugarcane plants, while ratoon renewal focuses on rejuvenating plants to enhance productivity. Both aim to increase sugarcane yield in tons per hectare. In 2024, IDR 22.3 billion will be allocated for ratoon care across 4,700 hectares of land, while in 2025, IDR 20.8 billion will be allocated for plant rejuvenation over 560 hectares.

In addition to intensification, the government is implementing extensification by opening 700,000 hectares of new land by Presidential Regulation No. 40 of 2023. This land expansion is expected to increase sugarcane production and support domestic sugar security. The primary focus of this policy is to increase sugarcane productivity from 67 tons per hectare to 93 tons per hectare. With the addition of new land and improved agricultural practices, the government aims to reduce dependence on sugar imports while strengthening the competitiveness of the domestic sugar industry. (Source: Tempo, 2024)

However, the low sugarcane yield in Indonesia, currently at only 7.3%, is one of the biggest challenges in achieving self-sufficiency targets. The government aims to increase this yield to 11.2%. This low yield is largely due to outdated and inefficient sugar mill machinery. Many mills in Indonesia use machines that are over 100 years old, hindering both the quality and quantity of sugar produced. Therefore, revitalizing sugar mills is crucial to ensure more efficient processing of sugarcane and better outcomes.

Although the government has established several strategic policies to increase sugar production, challenges remain in their implementation. Programs such as the Merauke Integrated Food and Energy Estate (MIFEE), which previously failed due to land mismatches, provide valuable lessons on the importance of thorough planning. Without a scientifically-based and well-managed approach, there is a risk that similar programs will fail. Therefore, the government must ensure that each policy and program is implemented with consideration of field conditions, while also heeding input from experts and industry players to achieve the desired results.

Meanwhile, CRIF Indonesia assesses that the success of the sugar self-sufficiency program heavily relies on infrastructure improvements, particularly in the modernization of sugar mill technology. Mills that use outdated machinery hinder efficiency and production quality. Revitalizing sugar mills by replacing old machines with more advanced technology must be a top priority to meet self-sufficiency targets. Furthermore, CRIF Indonesia emphasizes the importance of sustainable land extensification planning. The opening of 700,000 hectares of new land must be conducted with attention to ecosystem sustainability and soil capacity, to prevent the expansion from causing adverse environmental impacts. CRIF Indonesia believes the government must ensure that every step of extensification is carefully planned with long-term sustainability in mind.

Reforming the Sugar Sector is Key to Indonesia’s 2028 Self-Sufficiency and Competitiveness

CRIF Indonesia highlights the importance of systemic improvements in the sugar sector to achieve the 2028 sugar self-sufficiency target. The primary focus must be on revitalizing aging sugar mills, increasing sugarcane agricultural productivity, and adopting more efficient processing technologies. Additionally, CRIF emphasizes the importance of sustainable land expansion with proper selection of sugarcane planting areas. Without significant updates to infrastructure and agricultural practices, Indonesia’s goal of reducing dependence on sugar imports and stabilizing domestic sugar prices will be difficult to achieve. This sector requires a well-coordinated strategy involving the government, industry players, and farmers to boost sugar production and strengthen Indonesia’s competitiveness in the global market.

Furthermore, CRIF Indonesia also highlights the serious impact of corruption scandals, particularly those related to the management of sugar import quotas. Such practices not only disrupt local market stability but also undermine Indonesia’s efforts to become self-sufficient in sugar production. The trust crisis resulting from these scandals exacerbates challenges in achieving production targets, as it diminishes public confidence in the government’s ability to reform the sector. CRIF urges higher transparency and accountability in managing sugar imports, emphasizing that eradicating corruption is vital for creating a fair and efficient market that ultimately benefits local producers, and consumers, and supports long-term food security.