The fourth quarter of 2024 saw significant developments in the trend of Suspension of Debt Payment Obligation (PKPU) cases in Indonesia, reflecting the complex economic challenges faced by businesses. By the end of the year, the number of cases had risen to 171, with the manufacturing sector, particularly the textile industry, being the most affected. Factors such as rising production costs, exchange rate fluctuations, and surging imports of low-cost products have pressured the competitiveness of local industries. While most debtors continue to pursue debt restructuring through PKPU, more strategic measures are required to address the root causes and safeguard national economic stability. This article explores the latest developments, underlying factors behind the rise in cases, and their impact on Indonesia’s business landscape.

PKPU Trends Over the Last Three Years

Analyzing quarterly PKPU data from the past three years reveals fluctuating patterns that reflect the economic challenges faced by businesses in Indonesia. The highest number of cases occurred in Q3 2023, with 216 cases, likely influenced by global economic uncertainty and domestic pressures such as rising production costs and declining consumer purchasing power. In contrast, Q2 2024 recorded the lowest number of cases (126), indicating a temporary relief in corporate liquidity pressures, possibly due to restructuring efforts and improved financial adjustments within businesses.

In 2024, the total number of PKPU cases reached 624, averaging 156 cases per quarter. This figure is lower than 677 cases in 2023 and 636 cases in 2022, suggesting improvements in corporate debt management, operational efficiency, or government policies supporting economic stability. However, the increase in cases from Q2 2024 (126 cases) to Q3 (162 cases) and Q4 (171 cases) shows that liquidity challenges remain unresolved.

Based on our analysis, this pattern indicates that economic pressures peak in the middle and end of the year when companies face operational challenges and adjust their financial strategies. Key factors such as currency volatility, rising interest rates, and high operating costs continue to pose major obstacles. Thus, strategic financial risk mitigation measures, including stricter debt management and enhanced operational efficiency, must help businesses withstand dynamic economic pressures.

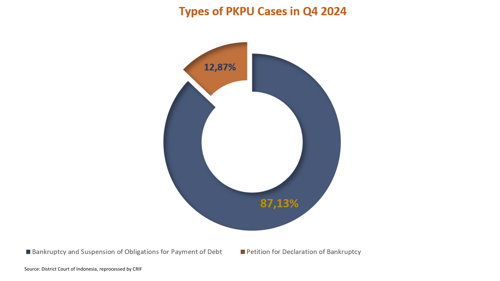

PKPU vs. Bankruptcy Cases in Q4 2024

Our data reveals that 87.13% of debt-related cases in Q4 2024 were PKPU, while 12.87% were bankruptcy cases. The high proportion of PKPU cases suggests that most debtors are still attempting to restructure their debts through mediation and negotiation before reaching bankruptcy.

PKPU allows debtors to develop debt repayment plans approved by creditors, while bankruptcy occurs when negotiations fail and debtor assets must be liquidated. According to CRIF, the dominance of PKPU cases indicates businesses’ efforts to survive liquidity pressures, highlighting the importance of efficiency and transparency in dispute resolution to mitigate broader economic impacts.

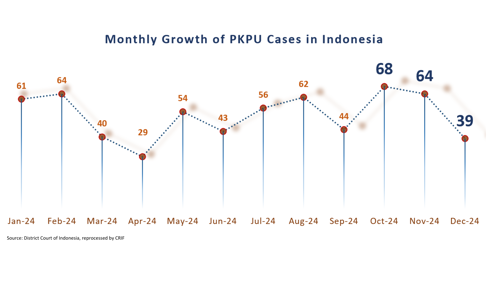

October recorded the highest number of PKPU cases (68), while April had the lowest (29). The fluctuating trend reflects financial pressures linked to the closing of financial reports at the start and end of the year.

The decline in cases during certain months, such as April and June, suggests seasonal pauses within business cycles. CRIF emphasizes the importance of strategic cash flow management throughout the year, especially during periods of heightened financial stress. These fluctuations also indicate that companies are attempting to resolve obligations before entering the final quarter.

To maintain business stability and reduce systemic economic risks, CRIF recommends:

- Enhancing financial risk management

- Regular debt evaluations

- Improving legal processes' efficiency

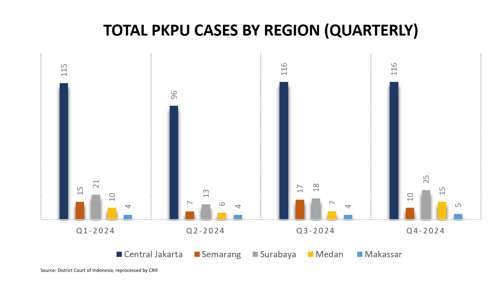

The Central Jakarta Commercial Court continued to dominate PKPU case filings throughout 2024, reflecting the concentration of liquidity pressures in Indonesia’s main business and financial hub.

Although case numbers in cities like Semarang, Surabaya, Medan, and Makassar remained lower, fluctuations suggest that financial challenges are spreading to other regions, particularly Surabaya, which experienced a surge in Q4 2024.

Under Presidential Decree No. 97/1999, PKPU and bankruptcy cases can only be filed at five designated Commercial Courts, each serving multiple provinces:

-

Makassar – Covers Sulawesi, Maluku, and Papua

-

Medan – Covers Sumatra (excluding South Sumatra and Lampung

-

Surabaya – Covers East Java, Kalimantan, Bali, and Nusa Tenggara

-

Semarang – Covers Central Java and Yogyakarta

-

Jakarta Pusat – Covers Jakarta, West Java, South Sumatra, Lampung, and West Kalimantan

These jurisdictions reflect the high concentration of economic activity in major regions, where business and industrial sectors operate at scale.

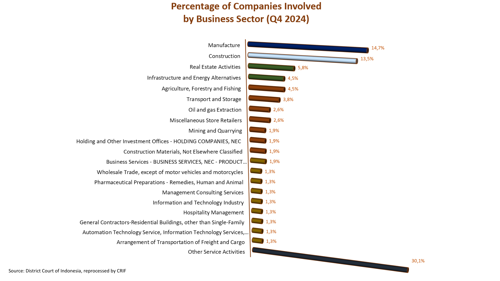

Which Industries Were Most Affected by PKPU in Q4 2024?

According to data for Q4 2024, the manufacturing sector recorded the highest share of Suspension of Debt Payment Obligation (PKPU) cases, accounting for 14.7%, followed by construction (13.5%). Other significantly impacted sectors included real estate activities (5.8%) and agriculture, forestry, and fishing (4.5%).

CRIF's analysis indicates that the high number of PKPU cases in the manufacturing and construction sectors reflects serious liquidity challenges faced by large companies that heavily rely on external financing and are exposed to long-term project risks. This trend suggests that economic uncertainty and shifts in the financial market significantly impact business sustainability in these sectors.

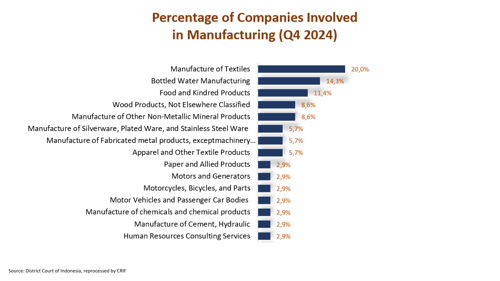

The manufacturing sector exhibits considerable variation in the industries involved in PKPU cases during Q4 2024. Among them, textile manufacturing recorded the highest share at 20.0%, underscoring the industry's dependency on stable cash flow and challenges in meeting debt obligations.

Other significantly affected manufacturing subsectors include:

🔹 Bottled Water Manufacturing – 14.3%

🔹 Food and Related Products – 11.4%

🔹 Non-Metallic Mineral Products – 8.6%

🔹 Wood Products – 8.6%

According to CRIF, the high number of PKPU cases in manufacturing industries highlights the pressure on sectors with high production costs and dependency on imported raw materials. Given the ongoing economic uncertainty, companies in these industries must focus on liquidity management and funding strategies to mitigate bankruptcy risks.

Challenges and Trends in Indonesia’s Textile Manufacturing PKPU Cases in Q4 2024

Indonesia’s textile and textile product (TPT) industry faced significant challenges in Q4 2024. The textile manufacturing sector was the hardest hit by Suspension of Debt Payment Obligation (PKPU) cases, accounting for 20% of all manufacturing PKPU cases during this period.

Several major companies in the sector faced financial distress, leading to mass layoffs:

- PT Asia Pacific Fiber laid off 2,500 employees

- PT Chingluh Indonesia laid off 2,000 employees

- PT Pismatex laid off 1,700 employees due to bankruptcy

- PT Tuntex Garment and PT Wiska Sumedang laid off 1,163 and 700 employees, respectively (Source: Databoks)

One of the main contributors to the financial strain in the textile industry is the surge in low-cost textile imports, which has significantly weakened the competitiveness of domestic manufacturers.

Another major factor is the delay in extending additional import tariffs on fabrics, which previously expired in 2022. The absence of these protective measures created a policy gap, allowing importers and bonded-zone garment factories to use cheaper imported fabrics. This resulted in lower demand for locally produced textiles and forced several domestic fabric manufacturers to shut down (Source: Katadata).

To address these challenges, the Indonesian government plans to revise Trade Minister Regulation (Permendag) No. 8/2024. The revision aims to:

- Strengthen the production capacity of small and medium-sized enterprises (SMEs) in the textile sector

- Enable SMEs to meet the demand for affordable products priced under IDR 200,000 per unit

- Enhance the competitiveness of locally produced textiles and protect domestic manufacturers from external pressures

Conclusion and Strategic Solutions

The rising PKPU cases in Q4 2024 reflect persistent liquidity pressures amid an economic recovery that remains unstable. The textile industry, as the largest contributor to PKPU cases, is facing intense competition from imported goods and high operational costs.

To safeguard and revitalize the sector, the following measures are crucial:

- Regulatory Reforms: Strengthening policies like Permendag No. 8/2024 to improve local competitiveness

- Risk Management Strategies: Enhancing operational efficiency, product diversification, and cash flow optimization

- Stronger Government and Industry Collaboration: Implementing supportive fiscal policies and financial assistance programs

With strategic intervention and collaboration, Indonesia’s textile industry has the potential to recover and play a more significant role in national economic growth.