The development of debt payment suspension (PKPU) cases in Indonesia during the third quarter of 2024 has drawn significant attention within the economic and legal spheres. As business dynamics continue to evolve, debtors and creditors face various challenges. This quarter we recorded a notable increase in PKPU cases, highlighting critical economic and legal issues. This analysis explores the factors influencing the rise of PKPU cases, their financial implications, and the measures undertaken to address the situation.

Overview of PKPU Case Trends

Quarterly data on PKPU cases illustrates the interplay of economic and legal dynamics in Indonesia. The steady increase in PKPU cases reflects not a transient phenomenon but a trend requiring careful examination. The rise underscores the economic uncertainties affecting individuals and companies amid policy changes and global challenges. The data shows that PKPU cases have become a multifaceted issue that demands sustained attention to ensure economic stability and uphold legal justice.

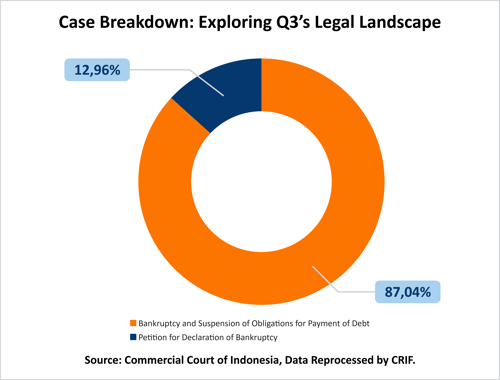

In Q3 2024, 87% of PKPU cases involved bankruptcy and debt payment suspension processes, while only 12% pertained to bankruptcy declarations. This indicates a preference for restructuring and repayment extension over immediate liquidation. Such trends underline the economic pressures various stakeholders face and their attempts to mitigate insolvency risks.

PKPU Cases by Region

Central Jakarta reported the highest number of PKPU cases, underscoring significant economic challenges in the region. Meanwhile, cities like Surabaya and Semarang recorded relatively lower numbers, though these still warrant close monitoring. Regions such as Medan and Makassar saw fewer than ten cases each, reflecting varying economic conditions across the country. These regional variations emphasize the need for localized strategies in addressing debt and financial issues.

Key Sectors Involved in PKPU Cases

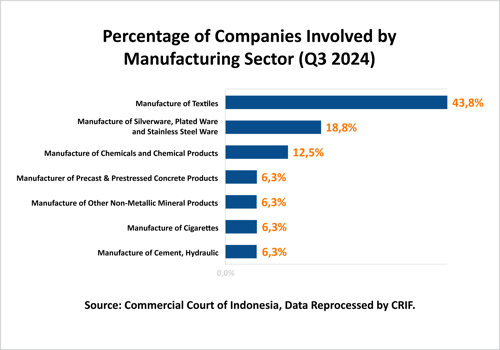

Several economic sectors were notably impacted during Q3 2024. Construction, manufacturing, and mining industries accounted for the majority of cases. Within the manufacturing sector, 43.8% of cases occurred in the textile industry, followed by 18.8% in metal processing and 12.5% in chemical production. The data highlights ongoing financial challenges in these areas, emphasizing the need for targeted interventions to stabilize key industries.

Challenges and Trends in PKPU Cases within Indonesia’s Manufacturing Sector in 2024

Indonesia’s manufacturing sector is facing significant pressures, reflected in ongoing contractions and financial distress among companies. Below are the key highlights:

-

Prolonged Contraction in Manufacturing Activity

-

-

Indonesia’s manufacturing activity has been contracting for four consecutive months, as indicated by the Purchasing Managers’ Index (PMI) released by S&P Global.

-

The PMI for October 2024 remained at 49.2, the same as in September. A reading below 50 indicates contraction, signaling continued challenges since July.

-

-

Weakening Domestic and Export Demand

-

-

Domestic consumer purchasing power has declined, compounded by a shrinking export market, which has been in correction for eight consecutive months.

-

Companies report rising inventories of finished goods due to weak demand, leading to decreased new orders and reduced production levels.

-

-

Rising Layoffs and Financial Strain

-

-

The strained business environment has led to widespread layoffs, with 59,764 workers affected by job cuts as of October 2024, a 12.78% increase from September and a 31.13% rise compared to October 2023, according to the Ministry of Manpower (Kemnaker).

-

In industries such as textiles and textile products (TPT), declining sales and order shortages have forced companies to close factories. According to Ristadi, President of the Confederation of Indonesian Workers’ Union (KSPN), layoffs initially aimed at efficiency eventually resulted in bankruptcies in several cases (CNBC Indonesia).

-

-

Declining Business Confidence

-

-

While businesses hold some optimism for recovery, their confidence has reached its lowest level in four months, well below historical norms.

-

-

Policy Recommendations for Recovery

-

-

The government is encouraged to strengthen fiscal stimulus policies, including tax incentives for substantial foreign investments.

-

Monetary policy interventions, such as reducing interest rates, can support businesses by making loans for investment and working capital more affordable.

-

Expanding import substitution programs and continuing downstream policies across agriculture, plantations, and fisheries could bolster domestic productivity.

-

Developing industrial zones outside Jabodetabek and Java is essential to distribute economic activities more evenly.

-

These measures, if implemented effectively, could help address the pressing challenges faced by Indonesia’s manufacturing sector, creating a more stable and resilient industry in the long term

Rising PKPU Cases in Indonesia: Challenges and Solutions

CRIF Indonesia highlights a significant rise in PKPU (Postponement of Debt Payment Obligation) cases in Q3 2024, signaling growing economic pressure on businesses. The manufacturing sector, particularly textiles, metal processing, and chemicals, has been the largest contributor, reflecting its vulnerability to economic shifts. External factors, such as unstable global economic conditions, have further aggravated the situation, making it harder for businesses to sustain operations.

To address these challenges, companies are encouraged to diversify products and markets, streamline production costs, and adopt technology to enhance efficiency. Strengthening supply chain partnerships is also critical for resilience. Resolving PKPU cases will require collaboration between the government, businesses, financial institutions, and the public to ensure a stronger and more sustainable economic future for Indonesia.