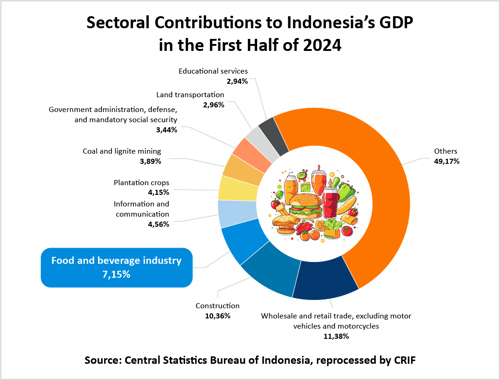

With a continually increasing population and soaring demand, Indonesia's food and beverage (F&B) industry has reached a crucial point in supporting the economy, contributing 7.15% to the national GDP in the first half of 2024. Despite rising production costs and regulatory changes, the sector has maintained stable growth, projected to increase by 4.53% in 2024. As we approach 2025, opportunities in this sector continue to expand, although challenges such as rising production costs and regulatory shifts will demand that businesses innovate and adapt to maintain growth.

In this CRIF Indonesia industry insight, we delve into the F&B sector's significant economic contributions and the strategic approaches businesses need to sustain momentum into 2025.

Positive Trends and Contributions of the F&B Industry

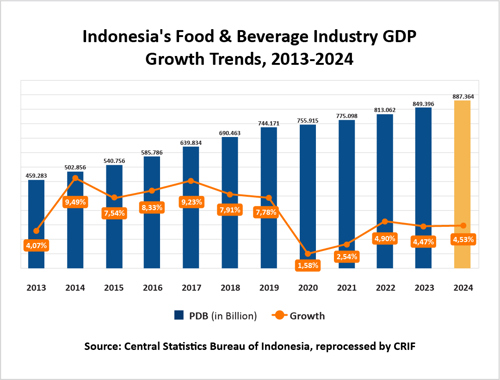

The F&B sector has shown remarkable GDP growth over recent years. According to data from Indonesia’s Central Statistics Agency (BPS), the sector saw a 4.47% increase in 2023, reaching IDR 853.716 trillion, and further projected growth of 4.53% by year-end 2024. This performance underlines the sector’s resilience and its importance to the national economy.

Several drivers underpin this sustained growth. Increased domestic consumption, fueled by population growth and evolving consumer habits, keeps demand high, while an expanding export market opens up additional opportunities. According to data from the Central Bureau Statistics of Indonesia (BPS), the F&B industry accounted for the third-largest contribution to the national GDP in the first half of 2024, following wholesale trade and construction. This underscores the significant role the F&B sector plays in Indonesia's economy.

With anticipated GDP growth rates in 2025, industry players are optimistic about reaching new milestones by leveraging innovation and tapping into rising consumer trends.

Preparing for Population-Driven Demand in 2025

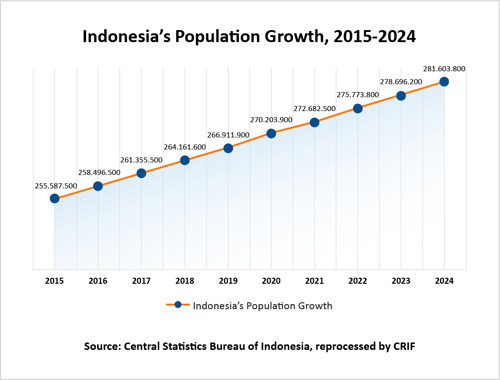

Indonesia’s growing population—projected to surpass 281 million by 2025—continues to fuel demand for food and beverages, underscoring the sector's potential. Since 2015, an annual population increase of around 3 million has consistently pressured the industry to enhance production capacity. This growth also brings diversified consumption preferences, especially as younger generations lean towards healthy, convenient, and technology-integrated food options.

Moving forward, successful players will proactively identify these trends, such as plant-based foods and organic options, to cater to urban consumers’ health-conscious choices in 2025.

Retail Growth and Shifting Consumer Patterns

According to the latest data from Euromonitor International, as reported by the United States Department of Agriculture (USDA) in the April 2023 edition titled "Indonesia: Food Processing Ingredients”, packaged food and beverage sales hit a high of USD 40.11 billion (IDR 601.65 trillion) in 2023, driven by the rapid expansion of minimarkets and shifting consumer preferences toward convenience.

Observing consistent growth year-on-year, with an impressive growth rate of 11.9% in 2022, the packaged food and beverage market in Indonesia continues to demonstrate a strong demand. Euromonitor International and the USDA underscore that urban Indonesians are increasingly relying on processed and packaged foods, with a steady demand for items like frozen meals and snacks. This momentum, expected to carry into 2025, points to a profitable market for companies prioritizing accessibility and variety through these channels.

Challenges Facing the Food and Beverage Industry in Indonesia

-

Rising Production Costs Due to Imported Raw Materials

The Indonesian food and beverage industry is currently grappling with significant challenges. One of the most pressing issues is the rising production costs, primarily driven by the high prices of imported raw materials. Many local industry players rely on these imports to maintain product quality. When raw material prices increase, so do product prices, placing a burden on consumers.

-

Impact of Wage Increases and Value-Added Tax (VAT) Implementation

Increasing labor costs and the proposed implementation of a 12% Value Added Tax (VAT) in 2025 are predicted to add financial pressure on businesses in this sector, potentially hindering industry growth if not addressed with appropriate policies. The Institute for Development of Economic and Finance (INDEF) states that the VAT increase will adversely affect various sectors, including manufacturing, education, and accommodation.

-

Unbalanced Import Tariffs

Trade policies are also a crucial factor. Unbalanced import tariffs, where raw materials incur high costs while finished goods enter tax-free, hinder local producers' competitiveness against cheaper foreign products. The government needs to adjust import tariffs to support local industries. Meanwhile, industry players hope for a stable benchmark interest rate of 6.25% until the end of 2024, as many industries carry substantial bank debt. Any rise in interest rates could exacerbate conditions amid escalating logistics costs in several countries.

-

Logistical Issues and Capital Burdens

Additionally, logistical challenges have compelled many companies to increase their raw material inventories, thereby raising their capital burdens. Previously, businesses maintained stock for two weeks; now, some raw materials must be kept for up to two months. This intensifies pressure on operators from both operational and financial perspectives.

Despite these challenges, significant opportunities remain. Innovations in products, technology, and production efficiency are key to maintaining competitiveness. Product diversification, such as developing downstream products from seaweed commodities, shows considerable potential for the F&B industry. The global market is increasingly leaning towards high-value-added products like bioplastics and alternative proteins. Adapting to these trends is essential for the Indonesian food and beverage industry to continue contributing to the national economy.

Government support, through reducing import tariffs on raw materials, implementing more flexible fiscal policies, and enhancing logistics infrastructure, is vital for the industry’s future development. If these challenges can be effectively addressed, the food and beverage sector is optimistic about ongoing growth and innovation, positively impacting Indonesia's economy.

Strategic Recommendations for 2025

CRIF Indonesia anticipates that the F&B sector will benefit from both product diversification and technological investment to meet the demands of a growing and diverse consumer base. Exploring high-value product lines, such as bioplastics and alternative proteins, presents a promising avenue to stay competitive in the global market. Additionally, government support—via reduced import tariffs, fiscal incentives, and enhanced infrastructure—will be crucial to ensure long-term sustainability and growth.

As we look toward 2025, Indonesian F&B companies must brace for regulatory and cost challenges while innovating to capitalize on rising demand and shifting consumer preferences. By navigating these dynamics effectively, the F&B industry can continue to drive economic growth, solidifying its role as a cornerstone of Indonesia’s economy.