For Taiwan, Indonesia is a critical trading partner within the New Southbound Policy (NSP) framework, a strategic initiative President Tsai Ing-Wen launched to deepen collaboration with Southeast Asia, South Asia, Australia, and neighboring regions. Key areas of partnership include the food processing, steel, and machinery industries, as well as cooperation aligned with Indonesia’s Industry 4.0 agenda. Over the past eight years, Taiwan has made significant strides in promoting the NSP, especially in the economic and trade sectors.

Before the pandemic, Taiwan’s businesses heavily relied on China for production activities. In the five years leading up to the first half of 2020, approximately 42% of Taiwan’s investments—equivalent to USD 43.12 billion—were directed to China. In contrast, Indonesia ranked fifth, receiving USD 2.05 billion, or 2% of Taiwan's total overseas investments.

In the first half of 2024, trade volume between Taiwan and the 18 countries under the NSP umbrella reached a total of USD 83.5 billion, marking a year-on-year growth of 12.43%. Exports alone amounted to USD 50.2 billion, a record high for the same period in previous years, according to the Taipei Economic and Trade Office (TETO) in Jakarta on October 8, 2024. Notably, Taiwan's cumulative investments in Indonesia now rank among the top five foreign direct investments (FDI) in the country and have contributed to the creation of approximately one million jobs for Indonesians.

Indonesia continues to be a prime destination for FDI in the Asia-Pacific region, driven by its expansive domestic market and abundant natural resources. Furthermore, reform initiatives such as the Omnibus Law are expected to attract even more foreign investment. By reducing barriers, offering tax incentives, and enabling greater foreign ownership in strategic projects, these reforms position Indonesia as a more competitive and appealing investment hub for international stakeholders.

Investment Trends of Taiwan in Indonesia

Taiwan’s Foreign Direct Investment (FDI) in Indonesia is part of a broader trend of increasing investments in Southeast Asia, as Taiwan seeks to diversify its economic engagements away from China. Between 2016 and 2018, Taiwan’s FDI inflows to ASEAN countries grew significantly, reaching $4.2 billion in 2016, positioning Taiwan as the seventh-largest source of FDI in the region. The emphasis on Southeast Asia has been reinforced under Taiwan’s New Southbound Policy (NSP), which aims to reduce economic dependence on China. By 2019, 47% of Taiwan's total overseas investments were directed to ASEAN, with 40% allocated to Vietnam, followed by Malaysia, the Philippines, and Indonesia. While Indonesia is a key recipient, it is not the largest beneficiary of Taiwan’s investments.

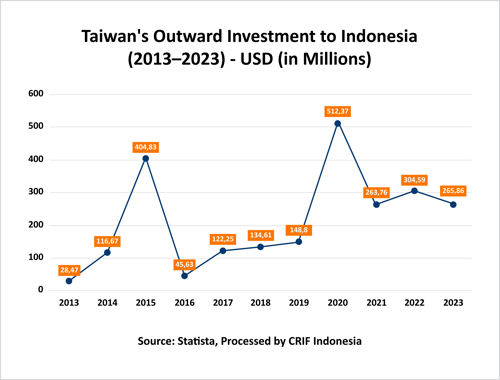

In 2023, Taiwan’s investments in Indonesia amounted to approximately $265.86 million. This figure reflects the continuation of Taiwan's steady investment strategy in Indonesia, demonstrating a positive trend in capital flows and underscoring Taiwan’s interest in diversifying its investment portfolio while capitalizing on Indonesia’s expanding market potential

According to Statista and data processed by CRIF Indonesia, broader economic factors—including geopolitical tensions, global economic conditions, and domestic policies aimed at improving investment climates—impact FDI flows globally. Developing economies like Indonesia face challenges in attracting foreign investments amidst these trends. Specifically, FDI inflows to developing Asian countries saw an overall decline of 8% in 2023, highlighting the increasingly competitive landscape for foreign capital.

Despite these challenges, the start of 2024 showed promising signs of renewed investment flows. Taiwan’s government recorded 243 overseas investment projects (excluding China) worth $12 billion during January-April 2024, marking a significant 61.10% increase compared to the previous year (Ministry of Economic Affairs, Taiwan).

During the 2024 Trade Expo Indonesia (TEI), a series of Memorandums of Understanding (MoUs) were signed between companies from Taiwan and Indonesia, amounting to USD 114.04 million (approximately IDR 1.78 trillion). These agreements, focused on services and carbon capture and storage investments, involved seven Taiwanese companies and eight Indonesian firms.

Arif Sulistiyo, Head of the Indonesian Economic and Trade Office (KDEI), emphasized that these partnerships are expected to unlock new business opportunities and drive expansion for both countries across various sectors. Strategic collaborations like these are pivotal in fostering mutually beneficial synergies and accelerating economic growth for both nations.

The evolving cooperation underscores the importance of sustained and strategic partnerships to bolster economic ties and drive innovation and competitiveness in a rapidly shifting global economic landscape.

Four Key Conditions for Taiwanese Investors to Relocate Textile Factories to Indonesia

Coordinating Minister for Economic Affairs, Airlangga Hartarto, announced that Taiwanese textile investors are considering relocating their factories from China to Indonesia. This statement followed a visit from 15 foreign investors, including members of the Taiwan Textile Federation and the Indonesian Textile Association, to the Coordinating Ministry of Economic Affairs on November 1, 2024 (Ekonomi.bisnis.com).

The relocation plans hinge on the Indonesian government meeting specific prerequisites proposed by the investors. Among the key players, Formosa Taffeta Co. outlined four critical conditions for moving their operations to Indonesia:

1. Streamlined Land Acquisition

Investors emphasized the importance of easier land acquisition processes. Airlangga encouraged these textile companies to establish factories within designated industrial zones. Setting up outside these zones would involve longer permitting processes, particularly related to environmental impact assessments (AMDAL).

2. Access to Green Energy

Adhering to Environmental, Social, and Governance (ESG) standards, the investors called for greater availability of green energy. West Java, in particular, has various renewable energy sources, including hydropower, floating solar plants, and gas. Expanding access to such resources will be critical for aligning with the sustainability goals of Taiwanese investors.

3. Competitive Gas Prices

The investors pointed out that Indonesia’s gas prices are relatively high, often exceeding $12 per MMBTU, compared to the average global benchmark of $9 per MMBTU. They urged the government to provide more affordable and competitive gas pricing to support industrial activities.

4. Improved Export Market Access

Export competitiveness remains a pressing concern for Taiwanese businesses. While Vietnam has benefited from Free Trade Agreements (FTAs) with Europe, giving it a significant advantage in export costs, Indonesia is still in the process of negotiating similar agreements, such as the Indonesia-European Union Comprehensive Economic Partnership Agreement (IEU-CEPA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

Currently, Indonesian exports to Europe face tariffs ranging between 16% and 20%, in contrast to Vietnam's near-zero tariffs under its FTAs. Securing these agreements would not only enhance Indonesia’s export competitiveness but could also attract additional factory relocations from Vietnam to Indonesia.

Taiwan’s direct investments in Indonesia remain underutilized, especially in strategic sectors such as green energy, high-tech manufacturing, and infrastructure. Both countries have complementary strengths: Taiwan provides advanced technology, while Indonesia offers a vast and growing market.

Reforms in Indonesia’s investment framework, such as streamlined processes and improved trade agreements, will serve as key catalysts for stronger Foreign Direct Investment (FDI) inflows in the future. By addressing these four conditions, Indonesia has the potential to strengthen its position as a prime destination for Taiwanese investments, driving mutual economic growth and fostering long-term strategic partnerships.

Key Sectors Attracting Taiwanese Investment in Indonesia

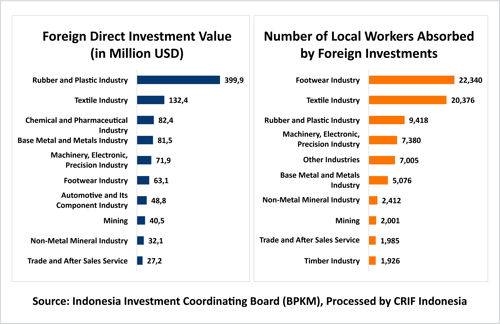

Over the past five years (2015–2020/Q1), Taiwan's investments in Indonesia have been concentrated in strategic industries. Among these, the rubber and plastics sector dominated with an investment value of USD 399.9 million (37% of total investments). However, this capital-intensive industry only absorbed around 9,418 workers, reflecting its reliance on advanced technology and machinery rather than labor.

In contrast, labor-intensive sectors such as footwear and textiles demonstrated a higher capacity for job creation. The footwear industry, with an investment of USD 63.1 million (5.8%), employed 22,340 workers, making it the leading sector in job creation. The textile industry, with an investment value of USD 132.4 million (12.3%), provided 20,376 jobs, ranking second in employment impact. While the investment figures for these sectors are lower than for rubber and plastics, their significant contributions to employment highlight their importance for addressing unemployment in Indonesia.

Other sectors, such as chemicals and pharmaceuticals (USD 82.4 million) and basic metals (USD 81.5 million), contributed moderately in both investment value and job absorption. Meanwhile, machinery, electronics, and precision manufacturing attracted USD 71.9 million in investments, creating approximately 7,380 jobs—sectors such as mining, trade, and non-metal minerals recorded relatively lower investment values and job creation.

CRIF Indonesia views Taiwanese investments in Indonesia as a balanced interplay between labor-intensive industries that generate significant employment and capital-intensive sectors that drive technological and productivity advancements. To fully harness this potential, the Indonesian government must support both types of sectors. Labor-intensive industries like textiles and footwear should be prioritized to tackle unemployment, while investments in capital-intensive industries, such as rubber, plastics, and precision manufacturing, should aim to enhance long-term industrial competitiveness.

Key Sectors of Interest for Taiwanese Investors

Taiwan's investment interests align with Indonesia’s strengths, focusing on four primary sectors:

-

Textiles and Apparel

Taiwan’s strong interest in the textile sector is evident in its expansion in regions such as Purwakarta, and West Java. This sector benefits from Indonesia's established supply chains and skilled workforce. -

Investment Conditions: Streamlined land acquisition processes, adherence to ESG standards, competitive gas pricing, and export market stability are crucial for realizing this potential.

-

Electronics and Electrical Equipment

Electronics remain a major focus for Taiwanese investors, leveraging Taiwan’s technological expertise. This includes investments in communication equipment, audio devices, and electrical machinery. There is also growth potential in semiconductor manufacturing, as Indonesia seeks to attract Taiwan's high-tech industries. -

Renewable Energy

With a global shift toward sustainable energy, Taiwanese companies are exploring opportunities in Indonesia’s renewable energy sector. This aligns with Indonesia's goals for energy transition and sustainability, fostering environmental and economic benefits. -

Manufacturing

Beyond textiles and electronics, Taiwan’s investments extend to basic metals, machinery, and diverse manufacturing sectors. Strategic projects, such as a USD 170 million initiative in Kendal Industrial Park, highlight efforts to capitalize on Indonesia’s vast resources and labor market.

Conclusion: Taiwan’s Digital New Southbound Policy and Strengthened Economic Ties

The Digital New Southbound Policy represents Taiwan’s broader strategy to deepen economic cooperation with Southeast Asia, including Indonesia. While Indonesia is a key investment destination, it competes with other ASEAN countries that attract more Taiwanese capital. This policy emphasizes:

-

Integration of Taiwanese enterprises,

-

Support for technology management,

-

Service innovation, and

-

System integration to enhance technology partnerships in the region.

Taiwan’s FDI in Indonesia reflects growing trust in Indonesia’s economic potential and the strategic importance of Southeast Asia. As both nations navigate global economic challenges, fostering a conducive environment for foreign investment will remain critical for sustainable growth. This collaboration offers opportunities to strengthen bilateral economic ties and establish a foundation for inclusive and long-term development in the region.