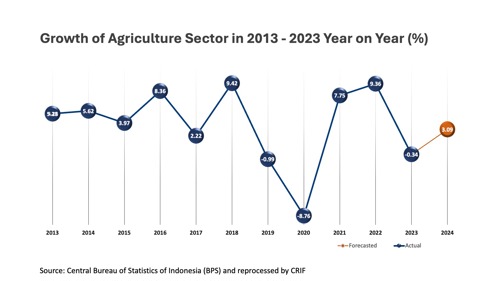

Despite a significant sales decline throughout 2023 due to uncertain global geopolitical and economic conditions, Indonesia's footwear industry is expected to experience positive growth in 2024. According to CRIF Indonesia, a global leader in credit bureau, business information, and credit risk solutions, the sector is projected to grow by approximately 3.09% compared to the previous year. This reflects optimism for recovery and expansion despite substantial global challenges. The anticipated growth is attributed to the industry's ability to adapt to changes and seek new opportunities in broader markets.

The anticipated 3.09% growth in Indonesia's footwear industry is closely linked to increased investment in the leather goods and footwear sector. Data from the Indonesia Investment Coordinating Board (BKPM) indicates that between January and September 2023, domestic investment in this sector reached IDR 1.1 trillion, while foreign investment totaled USD 574.3 million. Firman Bakrie, Executive Director of Aprisindo, highlighted that investment in the industry has grown significantly in recent years, even amid the pandemic. This surge in investment reflects strong investor confidence in the sector's potential, which is expected to drive innovation and expansion both domestically and internationally.

This confidence extends beyond manufacturers to the broader business community. According to Kontan.co.id, several companies are optimistic about achieving growth in 2024. For example, PT Erajaya Swasembada Tbk (ERAA) and PT Sinar Eka Selaras Tbk (ERAL) are targeting a 15% performance growth next year, fueled by positive business prospects and the anticipation of continued economic growth. Additionally, the growing consumer preference for eco-friendly and locally made footwear presents new opportunities for the industry to innovate and capture a larger share of an increasingly competitive market.

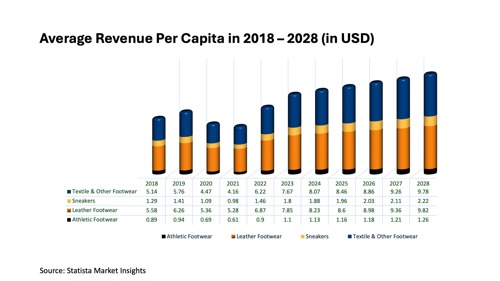

The growing confidence in Indonesia's footwear industry is not only driven by the rising popularity of local brands but also supported by research from Statista.com, which projects that the country's footwear market will reach a value of USD 5.49 billion by 2024. The leather footwear segment is expected to contribute the largest share, approximately USD 2.34 billion. The market is anticipated to grow at an annual rate of 5.50%, with market volume projected to reach 314.50 million pairs by 2028. Additionally, consumer trends reveal a strong shift towards eco-friendly and locally produced footwear, which has emerged as the top choice for many buyers. This shift in consumer preference towards more sustainable and locally-made products signals a promising future for Indonesia's footwear industry.

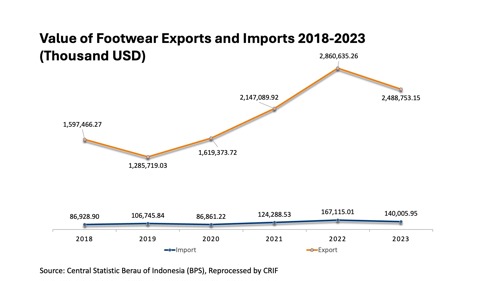

Amidst the optimism surrounding market growth and the shift in consumer preferences towards the local market, the Indonesian footwear industry is facing significant export challenges in 2023. Data from the Central Bureau of Statistics (BPS) shows that the export volume of the leather and footwear sector reached approximately 376,200 tons in 2023, reflecting a 14.24% decline compared to the previous year. Additionally, the export value decreased by 15.29% to USD 7.6 billion.

Stagnation and Declining Exports in the Footwear Industry

In 2023, Indonesia's footwear industry encountered significant challenges, highlighted by a sharp decline in sports shoe exports. According to BPS data, the export volume of sports shoes fell to 204,020 tons, a 25.15% decrease from the previous year. The export value also plummeted, dropping from USD 5.79 billion in 2022 to USD 4.3 billion in 2023, representing a 25.78% decline. This downturn was driven by changes in trade policies, logistical challenges, and persistent global economic uncertainty.

However, BPS data also shows that the footwear industry grew by 5.90% year-on-year (YoY) in the first quarter of 2024, contributing positively to GDP. This marks an improvement from the same period last year, which saw a contraction of -2.75% YoY. Export growth in the leather and footwear sector was modest at 0.95%, while imports decreased by 1.38%.

Despite these positive indicators, the export value of footwear in 2023 experienced an additional 13% decline from 2022, totaling USD 2.49 billion. Simultaneously, footwear imports dropped by 16.22% to USD 140.01 million, with most imports originating from China. In response, the government is striving to diversify export markets by promoting exports to non-traditional destinations and reducing dependency on traditional markets such as the United States, the European Union, Japan, and China.

Growth Challenges in the Footwear Industry

The footwear industry in Indonesia faces significant challenges, particularly with business licensing, as it aims to achieve ambitious growth targets in the coming year. A conducive business environment is essential for fostering positive performance in the manufacturing sector. However, issues such as land acquisition and bureaucratic delays continue to hinder progress. For instance, a planned investment in a shoe factory in Sragen, Central Java, was abandoned due to complications in land acquisition, postponing the factory’s construction. These licensing delays not only inflate investment and operational costs but also stifle job creation and impede more robust industry growth.

Overall, the business licensing process, especially in the footwear sector, remains fraught with uncertainty. Clear and timely licensing is vital for businesses, which often operate under strict targets and deadlines. For example, companies must navigate expensive and time-consuming environmental impact assessments (AMDAL) when establishing operations. The transition from the former Building Permit (IMB) to the new Building Approval (PBG) and Certificate of Proper Function (SLF) has introduced additional complexity and costs. Moreover, many operational permits lack legal certainty, further complicating business activities.

To overcome these challenges, government intervention is crucial. Providing access to land at competitive prices, especially outside of industrial zones, would significantly alleviate the current complexities and delays in land acquisition, facilitating smoother and more efficient business operations in the footwear industry.

The Decline of an Industry Icon

The closure of PT Sepatu Bata Tbk’s (BATA) factory in Purwakarta on April 30, 2024, marks a significant turning point for Indonesia’s footwear industry. This event highlights the mounting challenges the sector faces amidst intensifying global competition and shifting market demands. Despite the government’s efforts to mitigate these issues through strict import regulations, such as Ministerial Regulations No. 36/2023 and No. 8/2024 aimed at curbing illegal imports and streamlining licensing processes, these measures often contribute to bureaucratic delays and logistical backlogs at ports.

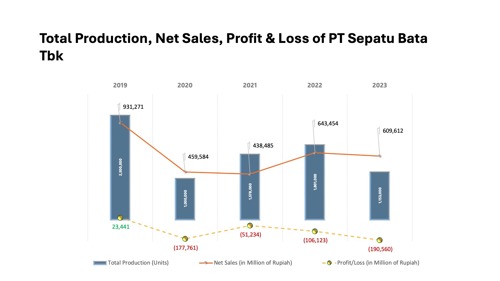

The ongoing struggles of the footwear industry, compounded by the long-term effects of the COVID-19 pandemic, have severely impacted companies like PT Sepatu Bata Tbk. The pandemic, which began in 2020, triggered a drastic reduction in production capacity, with the company’s output plunging by 60% that year. This contraction led to a 50.6% drop in sales, slashing revenue to IDR 459.6 billion. The financial fallout was severe, as the company posted a loss of IDR 177.7 billion in 2020, marking a significant downturn.

Although there was a slight recovery in production capacity during 2021 and 2022, the company continued to struggle financially, failing to return to profitability. By the end of 2023, PT Sepatu Bata Tbk had yet to fully recover, with cumulative losses amounting to IDR 525.68 billion over the 2020-2023 period. This prolonged financial decline underscores the deep-rooted challenges within the industry and the critical need for effective, supportive policies to restore its competitiveness and growth.