The rise of digital technology in Indonesia has impacted various industries, including the paper sector, which has seen a decline in performance. The growing popularity of movements like Go Green has significantly affected paper sales and usage, as consumers increasingly shift toward digital media.

A recent 2023 Nielsen survey revealed that 75% of respondents prefer products from companies with clear, measurable sustainability programs. This shift reflects the public’s rising concern for environmental and social issues.

According to Towardspackaging.com, the sustainable packaging market is expected to grow by 60% between 2024 and 2032. In Indonesia, where consumer awareness of sustainability is high, the country has become one of Asia's key influencers in developing sustainable packaging. One of the leading materials in this market is paperboard—thick paper used in various packaging products such as folding boxes and paper cups, commonly seen in takeaway food boxes and coffee cups

Paper Industry Strategies and Performance

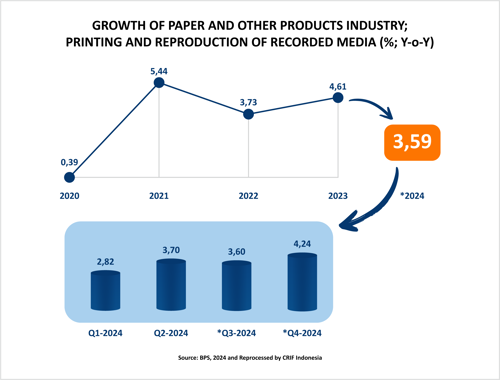

Despite the challenges, the paper industry has employed strategies to not only survive but also capitalize on changing market demands, such as the growing need for paper and packaging solutions. This led to a performance increase of 5.44% in 2021, and growth is expected to remain stable.

However, the industry’s journey has not been without setbacks. In 2022, growth slowed to 3.73% (a decrease of 1.71 percentage points) due to a weaker fourth quarter. Fortunately, 2023 saw a recovery with a year-over-year (YoY) growth of 4.61%, although quarterly growth dipped from 5.49% in Q3 to IDR 21.68 trillion.

The paper industry is projected to grow by 3.59% in 2024. The sector experienced 3.70% growth in the last two quarters and is expected to reach 4.24% YoY by Q4. This optimism is driven by rising industry confidence, with the Industrial Confidence Index (IKI) for the paper sector at 81.1%.

Export Activities and Challenges

The paper industry has strong potential to contribute to Indonesia’s export market. However, certain production challenges must be addressed. A 2023 study by the Ministry of Industry highlighted the need for equipment modernization. Many paper producers still rely on outdated technology, which hampers operational efficiency and the industry's ability to adapt to new challenges.

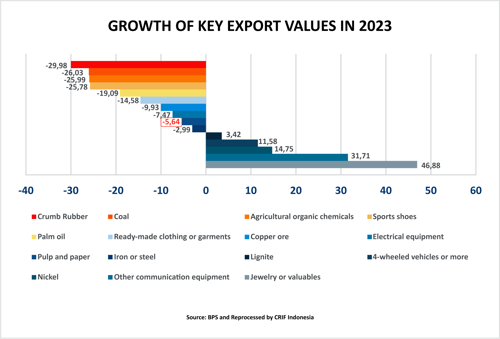

According to data from BPS (Statistics Indonesia), paper products ranked 9th in 2023’s export growth, with a decline of 5.64%. The fluctuation in global pulp prices played a major role in this decrease. Additionally, the government’s foreign exchange retention policy, which requires exporters to hold 30% of their revenue in foreign currency, has created operational difficulties, especially in managing cash flow for raw material purchases and payroll.

Opportunities and Barriers to the Paper Industry

The upcoming 2024 political landscape presents an opportunity for growth in the paper industry, which experienced a slowdown in late 2022. In Q3 of 2023, the industry recorded its highest post-pandemic growth at 6.58%, only to slow in Q4.

However, regulatory challenges remain. The Indonesian Pulp and Paper Association (APKI) has expressed concerns over import restrictions set by the Ministry of Trade’s Regulation No. 36/2023, which could burden the industry.

Internationally, the paper industry faces competition under the Regional Comprehensive Economic Partnership (RCEP) agreement. Since January 2023, Chinese paper products have entered the Indonesian market with zero tariffs, while Indonesian exports to China face tariffs of 5%-7%. Additionally, the European Union’s anti-deforestation regulations and Waste Shipment Regulations will likely affect Indonesia’s paper exports, requiring stricter compliance and increasing operational costs for local producers.

Domestically, the government’s foreign exchange retention policy also poses challenges, as it ties up funds that could otherwise be used for production. Furthermore, the Commodity Balance (NK), which tracks national consumption and production of certain commodities, including recycled paper, needs better synchronization among ministries. Previous issues with industrial salt imports, a key input for pulp and paper, highlight the importance of streamlined import processes for the industry’s continued growth.

The Downfall of PT Kertas Kraft Aceh

One notable case is the bankruptcy of PT Kertas Kraft Aceh (Persero), a state-owned paper company. Established under Government Regulation No. 31/1982, the company ceased operations following a bankruptcy filing on January 3, 2024. The company struggled with supply chain disruptions, particularly a lack of pine raw materials and affordable gas, which led to operational inefficiencies.

By April 2023, the Indonesian government issued Regulation No. 17/2023, which officially dissolved the company. Despite attempts to revitalize PT Kertas Kraft Aceh, it was determined that the company could no longer compete in the market due to poor performance, market disruption, and outdated technology.

Mitigate Bankruptcy Risks with CRIF

To avoid similar risks, businesses can focus on growth while CRIF handles partner data verification. In a volatile industry like pulp and paper, making informed decisions is crucial. With CRIF’s Business Information Report (BIR), you gain valuable insights such as credit risk assessments, in-depth investigations, financial health reports, and future market prospects. CRIF ensures you are equipped with the knowledge to mitigate risks and confidently drive your business forward.