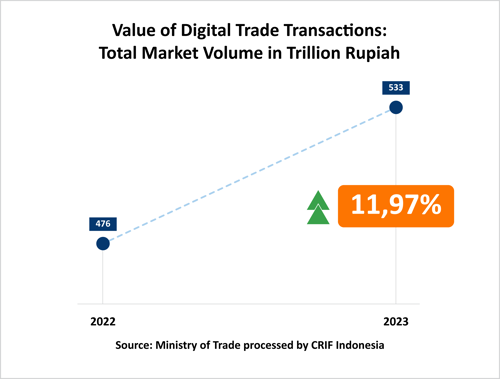

Indonesia's retail industry is entering 2024 with significant hurdles, ranging from Bank Indonesia’s high benchmark interest rate (BI rate) to the planned increase in Value-Added Tax (VAT) to 12% by 2025. These pressures dampen consumer purchasing power, as reflected in the retail sector's stable yet constrained growth rate of 4.95%. The Chairman of the Indonesian Retail Entrepreneurs Association (Aprindo) has suggested lowering the BI rate to 5.75–6% in the second half of 2024 to stimulate consumer spending. Meanwhile, e-commerce is thriving, with transaction values surging to IDR 533 trillion in 2023, underscoring a consumer shift toward online shopping.

Yet, optimism persists. The year-end holiday season, coupled with expectations of interest rate cuts, is anticipated to drive an increase in the Real Sales Index (IPR), which recorded a robust growth of 5.8% year-on-year in August 2024. Additionally, strategic partnerships between modern retail players and MSMEs are paving the way for an inclusive business model that strengthens the local retail ecosystem.

By leveraging digitalization and service innovation, the retail sector has the potential to navigate these economic complexities and achieve sustainable growth. Despite the challenges, there are golden opportunities for businesses to adapt, collaborate, and thrive in an evolving market landscape.

Resilience Amid Economic Turbulence

Indonesia's retail industry is navigating a dynamic and challenging landscape in 2024. Global economic uncertainties, fluctuating consumer purchasing power, and domestic fiscal policies are among the key factors influencing the sector's performance. Lower growth projections compared to the previous year add complexity to the situation for businesses.

The Bank Indonesia benchmark interest rate (BI rate) has emerged as a central concern. Its high level affects consumer loan repayments and dampens impulsive spending. The Chairman of the Indonesian Retail Entrepreneurs Association (Aprindo) has urged for a reduction of the BI rate to 5.75–6% by the second half of 2024 to support consumer purchasing power recovery. Compounding these challenges is the anticipated increase in Value-Added Tax (VAT) to 12% in early 2025. Aprindo has warned that this policy could drive retail prices higher by the fourth quarter of 2024, as businesses begin adjusting prices in advance. The association has called on the government to delay this policy to ease the burden on both consumers and retailers. (Source: CNBC Indonesia, 2024)

Despite these headwinds, the retail sector remains optimistic as the year progresses. Research Analyst Abyan Habib Yuntoharjo of Mirae Asset predicts improved performance in the fourth quarter of 2024, spurred by year-end holiday momentum and expectations of interest rate cuts. Mirae Asset also highlights long-term growth potential driven by urbanization, a productive-age population, and the increasing adoption of digital technologies. Some retail categories showed robust growth in August 2024, including cultural and recreational goods, motor vehicle fuels, and food and beverages. The Real Sales Index (IPR) for August 2024 reached 215.9, reflecting a 5.8% year-on-year increase, fueled by post-Independence Day celebrations. (Source: Liputan6, 2024)

Data compiled by CRIF Indonesia from the Central Statistics Agency (BPS) reveals that Indonesia's wholesale and retail trade sector has experienced fluctuating growth over the past decade. The highest growth rate was recorded in 2014 at 5.23%, followed by a gradual decline to a low of 3.07% in 2015. The sector then began a slow recovery, reaching 4.99% growth in 2018.

The COVID-19 pandemic in 2020 caused a sharp contraction in the sector, with a negative growth rate of -1.38%. This decline was attributed to large-scale social restrictions (PSBB), reduced consumer spending due to job losses, and disrupted supply chains leading to product shortages. In the years that followed, the sector gradually recovered, driven by the adoption of online shopping trends, increased economic activity post-vaccination, and government stimulus measures to boost household consumption.

Growth rebounded to 5.44% in 2022, supported by heightened consumer spending during holiday periods, relaxed mobility restrictions, and increased investments in retail digitalization. However, in 2023, growth slightly slowed to 4.92%, weighed down by global economic pressures such as high inflation and rising interest rates, which constrained consumer expenditures.

For 2024, CRIF Indonesia projects stable growth of 4.95%, reflecting moderate recovery prospects. This projection is supported by anticipated interest rate cuts, rising household incomes, and innovations within the retail sector aimed at meeting the increasingly segmented demands of the market.

In 2025, CRIF Indonesia projects a 5% growth in Indonesia's retail industry compared to 2024. This optimistic outlook is supported by various government initiatives aimed at bolstering the retail sector and enhancing the competitiveness of the domestic market. Among these initiatives, a strategic partnership between modern retail chains and traditional small retailers, known as toko kelontong, stands out. This program is designed to foster a mutually beneficial ecosystem where small retailers gain access to technology, business management training, and wider distribution networks, while modern retail chains expand their reach to local markets.

This collaboration is expected to improve the operational efficiency of toko kelontong through digital system integration, such as app-based inventory management and access to more competitively priced goods. It also enables small retailers to offer high-quality products at competitive prices, thereby attracting more customers. On the other hand, modern retailers can leverage the networks of toko kelontong to distribute products to hard-to-reach areas while strengthening brand loyalty at the local community level.

Additionally, this program is supported by other policies, such as subsidies for micro, small, and medium enterprises (MSMEs) in the retail sector and tax incentives for modern retailers participating in the development of toko kelontong. With these measures, the government aims to drive household consumption, reduce economic disparities between urban and rural areas, and create new job opportunities. If executed effectively, this transformation could provide a foundation for a more inclusive and sustainable retail sector in the future.

According to the Bank Indonesia (BI) Retail Sales Survey for October 2024, the Real Sales Index (IPR) recorded an annual increase, reaching 210.6, reflecting a 4.8% year-on-year (yoy) growth. This growth was primarily driven by the Food, Beverages, and Tobacco group, as well as the Apparel subgroup, while the Spare Parts and Accessories group, along with Motor Vehicle Fuel, continued to exhibit stable growth. However, every month, retail sales contracted by 2.5% month-to-month (MoM), attributed to a decline in consumer demand following the conclusion of various discount programs linked to Indonesia’s Independence Day celebrations. (Source: bi.go.id)

This data underscores the resilience of Indonesia's wholesale and retail trade sector in navigating external shocks and economic challenges. CRIF Indonesia highlights that one of the primary challenges facing the retail sector this year is how businesses can seamlessly integrate digitalization strategies with physical shopping experiences.

Today’s consumers are not only seeking the best prices but also convenience and personalized interactions at every touchpoint. Thus, technology-driven innovations and data analytics are key to maintaining customer loyalty. CRIF further asserts that by embracing better technological adaptation, retail players have significant opportunities to enhance operational efficiency and tap into broader markets.

Indonesia's retail industry in 2024 faces pressure from global economic slowdowns, tight monetary policies, and the looming increase in VAT rates. However, the sector continues to demonstrate resilience through innovation and strategic efforts to maintain competitiveness. Government support, optimism for the year-end quarter, and technology-driven adaptive approaches provide hope for industry players to overcome these challenges and drive sustainable growth in the years ahead.

Modern Consumers, New Strategies: Building Loyalty in the Digital Era

The resilience of Indonesia’s wholesale and retail trade sectors in navigating external shocks and economic challenges is evident from the sector’s sustained growth despite numerous obstacles. According to CRIF Indonesia, one of the primary challenges facing the retail sector in 2024 is seamlessly integrating digitalization strategies with physical shopping experiences. Modern consumers are no longer just price-sensitive; they demand convenience, personalization, and a cohesive shopping journey across various channels. This shift compels retailers to innovate by leveraging technologies such as artificial intelligence for customer analytics, personalized marketing campaigns, and more efficient supply chain management.

CRIF underscores that businesses that harness advanced analytics tools and digital technologies have the potential to unlock significant opportunities. These include improving operational efficiency, reducing costs, and reaching untapped market segments, such as rural areas and the expanding middle-class consumer base. Furthermore, the integration of e-commerce with physical stores enables retailers to cater to hybrid shopping preferences, fostering a more seamless customer journey and driving engagement and loyalty.

Despite pressures from global economic slowdowns, high interest rates, and the impending VAT hike in 2025, Indonesia’s retail industry remains resilient. Government initiatives, such as partnerships between modern retailers and traditional small businesses (warung), have created avenues for collaborative growth while promoting inclusivity within the retail ecosystem. These measures, combined with rapid technological advancements and increased consumer purchasing power in urban and semi-urban areas, are expected to strengthen the sector’s role as a key pillar of Indonesia’s economy.

The Impact of the VAT Increase to 12% on the National Economy

The Indonesian government has officially raised the Value Added Tax (VAT) rate to 12% in 2025 as part of the tax reform mandated by the Harmonization of Tax Regulations Law (UU HPP). This increase, up from the previous rate of 11%, has sparked significant reactions from business stakeholders, particularly in the retail sector, which serves as one of the cornerstones of the national economy. With the higher VAT rate, the cost of goods and services will rise directly. For consumers—especially those in the lower-middle-income groups—this could significantly weaken their purchasing power. Essential goods such as clothing, processed foods, and household necessities are likely to see declining sales as consumers opt to cut spending or switch to more affordable substitute products.

The increased VAT rate exerts a negative influence across economic components, with the most pronounced impact seen on economic output and GDP. At an 8% VAT rate, the additional economic output reached IDR 162.73 trillion, while at a 10% rate, this dropped to IDR 79.73 trillion. At a 12% rate, the impact turns negative, with economic output falling by IDR 79.71 trillion. A similar trend is observed in GDP, where the additional contribution at an 8% VAT rate was IDR 133.65 trillion. In contrast, a 12% VAT rate could lead to a reduction in Indonesia’s GDP by IDR 65.33 trillion.

Household consumption, one of the critical pillars of the economy, also experiences a significant decline. At an 8% VAT rate, household consumption added IDR 83.76 trillion to the economy; at a 10% rate, this contribution fell to IDR 40.69 trillion. At 12%, the figure turns negative, with a decline of IDR 40.68 trillion. This data highlights that a higher VAT rate directly diminishes consumer purchasing power. As VAT increases, prices of goods and services rise, reducing the volume of consumption. If this is not counterbalanced with subsidies or incentives to support purchasing power, the economic growth momentum may weaken further.

The VAT increase also affects the export sector, although its impact is relatively smaller compared to other economic components. At an 8% VAT rate, the additional export contribution was IDR 23.39 trillion, which fell to IDR 11.63 trillion at a 10% rate and turned negative at IDR 11.63 trillion under the 12% VAT rate. This decline can be attributed to indirect effects of higher VAT, such as increased production costs for export goods, which undermine the competitiveness of Indonesian products in global markets.

Under the 12% VAT scenario, economic growth is projected to slow to 4.03%, compared to the growth estimates of 5.1% projected by international institutions such as the World Bank and the IMF (as per the IMF’s World Economic Outlook October 2024 and the World Bank’s East Asia and Pacific Economic Updates 2024).

This 1.07% slowdown in economic growth reflects the negative ramifications of the VAT hike on economic activity, particularly through the weakening of household consumption—one of the primary drivers of growth. While the VAT increase is expected to bolster state revenues, its adverse consequences on economic growth warrant serious attention. Efforts must focus on mitigating pressures on consumer purchasing power and maintaining the stability of the business sector to ensure sustainable economic resilience.

The Impact of a 12% VAT Increase on Indonesia's Retail Industry

The increase in VAT to 12% poses a multifaceted challenge for Indonesia's retail sector. Its key effects include:

-

Decline in Consumer Purchasing Power: Low- to middle-income consumers are expected to bear the brunt, leading to reduced sales of consumer goods.

-

Pressure on Profit Margins: Retailers face a dilemma—either raise prices and risk losing customers or absorb part of the increased tax burden.

-

Greater Vulnerability for Traditional Retailers: Small shops and traditional markets may experience sharper revenue drops compared to modern retail outlets.

-

Price Hikes Across Supply Chains: Manufacturers are likely to increase prices to reflect the higher VAT rate, passing the burden onto consumers.

-

Adaptation through Digitalization and Promotions: Businesses are turning to e-commerce platforms, shopping apps, and promotional strategies to maintain customer loyalty.

Strategic Responses for Retailers

To address these challenges, retailers must adopt measures such as:

-

Operational Efficiency: Optimizing supply chains and inventory management to reduce operational costs, allowing for more competitive pricing.

-

Discounts and Bundling Promotions: Offering attractive deals to draw customers despite rising base product prices.

-

Embracing Digitalization: Leveraging e-commerce and shopping apps to expand reach and provide a diverse range of products at various price points.

While the initial effects of this VAT hike are expected to strain the retail sector, the broader fiscal reform is anticipated to yield long-term economic benefits. Increased government revenue from VAT can fund crucial infrastructure, education, and healthcare projects, potentially boosting consumer purchasing power over time.

However, the success of these reforms hinges on the government’s ability to ensure equitable distribution of benefits and create a business-friendly environment. Without adequate mitigation measures, the VAT increase could impose additional burdens on a retail sector still recovering from the pandemic.

The 12% VAT hike presents significant challenges for Indonesia's retail industry. Nonetheless, with adaptive strategies and supportive government policies, the sector has the potential to sustain growth amidst tax policy changes. Collaboration between businesses and the government will be vital to minimize the adverse impacts of the VAT increase while fostering sustainable economic growth.

Indonesia's local retail sector is increasingly challenged by the rise of global e-commerce giants like Amazon, Alibaba, and Shopee, which are intensifying their presence in the domestic market. While local retailers have an inherent advantage in understanding cultural nuances and consumer preferences, they must adapt to the convenience, speed, and competitive pricing offered by these global players.

Insights from the Ministry of Trade

According to data from the Ministry of Trade processed by CRIF Indonesia, Indonesia’s e-commerce transactions reached IDR 533 trillion in 2023, marking an 11.97% increase from the previous year. In contrast, data from the Central Statistics Agency (BPS) indicates that the retail industry grew by just 4.92% in 2023.

This disparity highlights a shift in consumer preference from physical stores to online shopping, driven by more competitive pricing, extensive promotions, and the convenience of shopping from home.

Despite these challenges, local retailers possess unique advantages such as personalized service, direct customer engagement, and an emotional connection with their customer base. Additionally, the sector plays a vital role in Indonesia’s economy, employing a significant portion of the workforce.

Strategic Recommendations for Local Retailers:

-

Digital Transformation: To compete effectively, local retailers must embrace digitalization. Technologies such as cloud-based point-of-sale systems, automated inventory management, and integration with local e-commerce platforms can streamline operations and expand market reach. Furthermore, building proprietary e-commerce platforms that emphasize unique local products can also differentiate local retailers from global competitors.

-

Strengthening Local Identity: Retailers should leverage their understanding of local consumer needs and preferences by offering products that reflect the cultural identity of Indonesia. Marketing campaigns that highlight the uniqueness and authenticity of local products—whether it’s food, fashion, or handicrafts—will resonate with consumers looking for meaningful connections with what they buy.

-

Strategic Partnerships with SMEs: Collaborations with micro, small, and medium enterprises (SMEs) can help strengthen supply chains and create a more inclusive business ecosystem. Government initiatives supporting partnerships between modern retailers and local corner shops can further expand distribution networks and create a more integrated retail landscape.

-

Enhanced Shopping Experiences: Traditional stores can enhance their in-person shopping experiences to compete with online convenience. Features like engaging store layouts, friendly customer service, and even entertainment options (cafes, play areas for children) can turn shopping into an experience rather than just a transaction. Incorporating cutting-edge technologies like Augmented Reality (AR) in stores can also offer unique experiences that attract tech-savvy consumers.

-

Innovative Services: To stay competitive, local retailers must innovate their services. Fast delivery, flexible payment options, and loyalty programs based on data analytics can provide consumers with the convenience they desire. Furthermore, using big data and analytics to understand consumer behavior can enable retailers to offer personalized promotions and recommendations that drive higher conversion rates.

Conclusion

The Indonesian retail industry in 2024 is facing a complex landscape shaped by external challenges, including the global economic slowdown, rising interest rates, and the VAT increase to 12%. While these factors are expected to pressure consumer purchasing power, there are reasons for optimism.

-

The upcoming holiday season and the anticipated reduction in the BI rate in the second half of 2024 could provide a much-needed boost to consumer spending.

-

The ongoing digital transformation and strategic partnerships with SMEs offer a path for local retailers to strengthen their competitive edge and grow their market share.

-

Consumers are increasingly shifting toward online shopping, as evidenced by the rise in e-commerce transactions, which reached IDR 533 trillion in 2023.

Despite the pressure from global e-commerce giants, local retailers can enhance their competitiveness by focusing on digitalization, service innovation, and emphasizing their local identity. Through government support, such as tax incentives and digital integration, the retail sector can continue to evolve and build a sustainable and competitive future.

By embracing technology and strategic partnerships, Indonesia’s retail industry can rise to the challenge, creating a more inclusive and resilient market for the future.